In the past 5 years there have been a plethora of startups popping up that offer an easy way to invest for the smaller investor.

As I was doing some research to find my top 5 companies to invest with I found a company that will allow you to invest with as little as $5. That company is called Stash Invest.

Stash not only lets you invest with small amounts and buy fractional shares, but also gives you a variety of interesting portfolios and investments that you can purchase. In fact, Stash offers more choices than many investment companies.

Here’s a review of Stash Invest, and a look at how they can help you to jump start your retirement savings.

Quick Navigation

Stash Invest Background

Stash was founded by Brandon Krieg and Ed Robinson as a place for first time investors to invest in a diversified portfolio, without having to have a big bankroll. After receiving all of the regulatory approvals, they launched the iOS app in October 2015. Here are the details from Wikipedia:

Stash was founded in February 2015 by Brandon Krieg and Ed Robinson. Krieg and Robinson had previously worked together at Macquarie Group, an investment banking firm. Stash was launched as an iOS app in October 2015, and was made available on Android in March 2016. Within a year of its launch, Stash had signed up 215,000 users. As of January of 2019 Stash has $530M+ in assets under management. Through January 2019, the app had approximately 3 million users.

So they’re pretty new to the scene having launched in October of 2015, but have quickly added almost 4 million users as of 2019.

Co-founder Brandon Krieg explains the idea behind the company on the company’s about page:

“My co-founder Ed and I left our jobs to start Stash because we believe everyone should have access to financial opportunity. After a combined 30+ years in the business, we saw that Wall Street can be fundamentally unfair to smaller investors as they work to accomplish their goals. Stash will change that. “

Stash should be a pretty attractive option for newer investors, so let’s see what they have to offer.

How Does Stash Work?

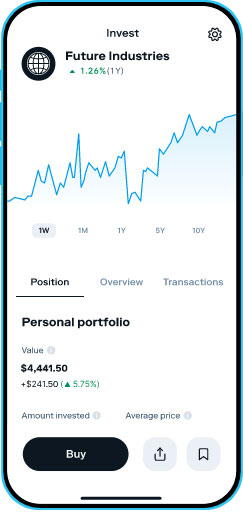

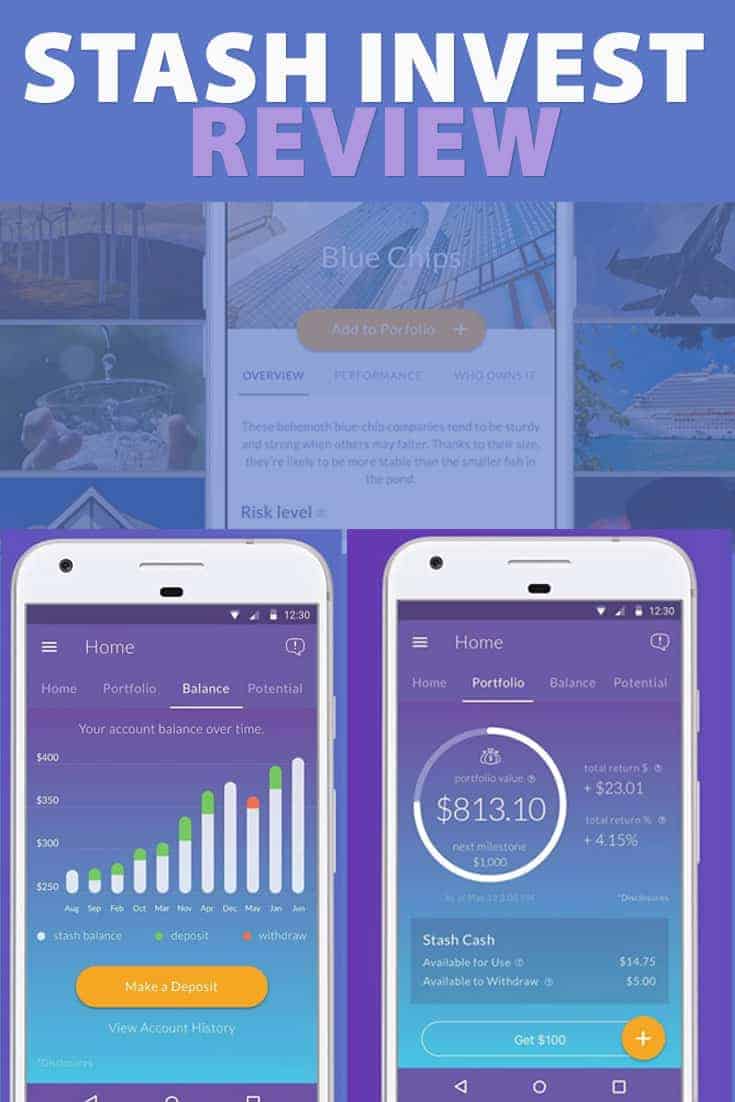

Stash is a micro-investing and banking app that is mainly utilized via a mobile phone app for iOS or Android. You can start investing with as little as $5.

Anyone can open an account, you just have to be 18 years old, and live in the United States.

Opening an account with Stash should only take a few minutes, and if you do it now they currently have a bonus offer. You’ll get a $5 account bonus for signing up, which is enough to start investing.

Sign Up For Stash Here – Get A $5 Bonus

To get started, you will need to answer a series of questions and provide your Social Security number, and then link an external bank account.

Based on your level of acceptable risk (conservative, moderate or aggressive) you’ll be given recommendations for portfolios.

Stash Investment Portfolios

Stash’s investments are mainly ETF index funds and they have 250+ETFs and stocks in pre-built investments that you can use to build your portfolio.

When you first open your account, the app will recommend a mix of diversified stocks that suits your level of risk.

In addition to their main 3 portfolios, there are an abundance of other investment options including funds focusing on large blue chip companies, small companies, environmentally friendly investments, technology, health care, banking, entertainment and more.

They talk about “investing in things you believe in”, and if that’s something you’re interested in doing, there are plenty of niche focused investments to partake in.

You can invest in just about anything your heart desires with Stash, just be cognizant of what the “risk level” is for each fund, and what the fund management fees are for the individual ETF funds you’re choosing as they can range from very low cost, to less so.

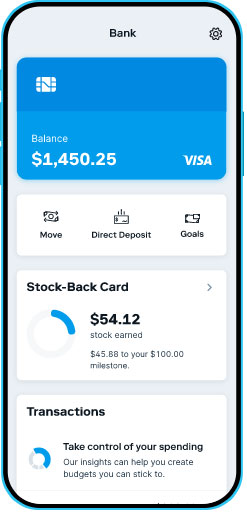

Stash Online Banking

Stash has an optional online banking account and Visa debit card that you can sign up for with your account. 1.

Some of the features of the account include:

- Early payday (Get paid up to 2 days early)

- No overdraft fees.

- No monthly maintenance fees.

- No minimum balance fees.

- Access to thousands of fee-free ATMs.

- Stock-Back® Rewards for everyday spending.

- Setup automatic transfers to keep the account funded.

This account is included in the regular monthly fee, and doesn’t have additional fees.

Stash Stock-Back® Rewards

Stash introduced a cool feature a while back that they call “Stash Stock-Back® Rewards” 2. It’s a rewards program of sorts that works in conjunction with your Stash debit card and your online banking. Instead of getting cash back, however, you’re getting fractional shares of stock where eligible.

Here’s how it works. Make a purchase with your Stash Visa at any of 11 million businesses nationwide, and you’ll get rewards for that purchase in the form of a fractional share of stock for that company (or for a diversified ETF index fund if that company isn’t available).

For example, if you buy something on Amazon with your Stash debit card, you’ll earn AMZN Stock-Back® as a reward.

As soon as you make a purchase using your Stash debit card, you should get a notification of the stock that you’ve earned. You’ll earn 0.125% Stock-Back® rewards on everyday purchases, and up to $5 Stock-Back® rewards at certain merchants. The stock will be added to your taxable brokerage account within your app. 3

Other Features of Stash

Here are some other important features and functionality of the app that are important to know about.

- Stash Retire: Stash recently has moved into the retirement investing space and they now offer Traditional and Roth IRA accounts.4 Those accounts have a minimum of $15 to invest.

- Smart-Save: Smart-Save functionality studies your spending and income patterns to figure out when you have cash to spare. Then it automatically saves small amounts of extra cash into your Stash account. There, it earns interest, or can be invested.

- ASAP Direct Deposit: Get paid up to 2 days early.5

- Automated investments: Set up a regular deposit and fund your account on an automated basis.

- Fractional shares: You can buy fractional shares – buying a small fractional share of a single stock.

- Educational materials: They have a decent array of educational materials available for newer investors in both the app, via email, and on their website.

- Tools to forecast: The app has a tool to see the impact your saving and investing might have over time. It gives you insight into how your positive choices are impacting your future.

- Security: Stash’s app uses 256-bit bank grade encryption to secure your personal information. Information sent between the app and their servers use SSL encryption, and they don’t store you your bank long information.

- SIPC Coverage: Your investments in your account are covered by Securities Investor Protection Corporation (SIPC) through the clearing agency used by Stash, Apex Clearing Corp. The limit of SIPC protection at any brokerage is $500,000, which includes a $250,000 limit for cash.

Stash Service Fees And Minimums

Where the rubber meets the road is just how much you’ll be paying to use Stash. What are the fees and minimums for using the service?

First of all, there is a $5 minimum in order to have an account, and you only need $5 to invest.6 So the service is accessible to just about everyone, especially if you get the $5 bonus mentioned above.

Low Monthly Fees

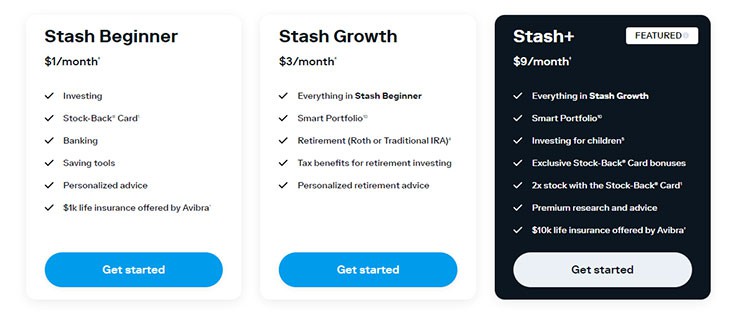

The service offers three monthly subscription plans. There is the Stash Beginner account for $1/month7 that includes a personal investment account, debit Visa card account access, Stock-Back® rewards program that helps you to earn stock for your normal spending, and free financial education.

The $3/month7 Growth subscription will give you everything in the basic account, but also includes access to retirement accounts.

The $9/month7 plan gives you everything in the above plans but adds in the option of custodial accounts where you can start investing for 2 kids, a metal debit card that also gives you 2x earnings on Stock-Back® rewards, as well as monthly market insights reports.

While $1/month isn’t really that much, the one caveat is that if you have a low balance account and you’re paying $1/month for the service, that fee could be a relatively large percentage of your assets in comparison to some other services. It might be something to consider. Stash becomes more cost effective in my opinion once your account reaches a higher dollar value, and at that point it’s very comparable to other investment sites like Betterment, Wealthfront and others.

Automated Investing With A Low Barrier To Entry

If you’re a newer investor and you don’t have a lot of money to start investing, Stash might be worth your time to get your feet wet. They have a low initial deposit of $5, and from there you can use dollar cost averaging to build your portfolio bit by bit. You can even start a Roth IRA or Traditional IRA and invest for retirement with Stash Growth.

Stash has a wide variety of investment options, and if you’re looking to hold a diversified portfolio, their basic mix portfolios can give you what you’re looking for.

While the fees aren’t the lowest, once the account grows to a reasonable level the fees are very comparable to other players in the space.

Try Stash for free with the currently available $5 account bonus!

Sign Up For Stash Invest Today!

| Robo-Advisor | Assets Under Management (AUM) | Annual Fee | Account Minimum | Bonuses | Review |

|---|---|---|---|---|---|

| Betterment | $15 billion | 0.25% of account balance. 0.40-0.50% w/ human advisors | None | Up to one year managed FREE | Review |

| Wealthfront | $12 billion | 0.25% of account balance | $500 | $5k managed FREE (Bible Money Matters readers) | Review |

| M1 Finance | $1 billion | FREE (fees for add-on services) | None | Review | |

| Blooom | $3 billion | $10/month any account size | None | FREE 401(k) Checkup | Review |

| Axos Invest | $153 million | 0.24% of account balance. | $500 | Review | |

| Acorns | $1 billion | $1/month under $5k. 0.25% of account balance above $5k. Free for college students. | None | Review | |

| Public | FREE | None | Free stock up to $15 | Review | |

| Stash Invest | $600 million | $1/month under $5k. 0.25% of account balance above $5k. | $5 | $5 New Account Bonus (Bible Money Matters readers) | Review |

| SigFig | $120 million | Under $10k FREE; 0.25% of account balance above $10k | $2,000 | ||

| Personal Capital | $8.5 billion | 0.49% to 0.89% of account balance | $25,000 | Review | |

| Wealthsimple | $5 billion | $0-$99,999 0.50%/yr; $100k+ 0.40%/yr | None | Up to $10k managed free (Bible Money Matters readers) | Review |

| Charles Schwab | $15.9 billion | FREE (They require you to hold 6-30% of portfolio in cash) | $5,000 | ||

| Fidelity Go | N/A | 0.35% of account balance; | $5,000 | ||

| Vanguard | $101 billion | 0.30% of account balance | $50,000 |

1 Debit Account Services provided by and Stash Visa Debit Card issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. In order for a user to be eligible for a Stash debit account, they must also have opened a taxable brokerage account on Stash. Account opening of the debit account is subject to Green Dot Bank approval.

2 Stash Stock-Back® is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program.

3 You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the custodian.

4 Stash does not monitor whether a customer is eligible for a particular type of IRA, or a tax deduction, or if a reduced contribution limit applies to a customer. These are based on a customer’s individual circumstances. You should consult with a tax advisor.

5 Early access to your direct deposit depends on deposit verification and when Green Dot Bank gets notice from your employer, and may vary from pay period to pay period.

6 Other fees apply to the debit account. Please see Deposit Account Agreement for details.

7 You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the custodian.

Bible Money Matters is a paid Affiliate/partner of Stash. Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser.

Share Your Thoughts: