One of the keys when it comes to investing for the long term is to make sure you’re minimizing the fees you’re paying to invest your money.

Whether it’s plan administration fees for the company you’re investing with, mutual fund expense ratios and fees, or fees for added account functionality, the more you can minimize how much you’re paying, the better.

Morningstar reports that the average expense ratio for actively-managed equity mutual funds is 1.2% and investment-grade bond funds have an expense ratio of 0.9%. For me, I prefer to invest in mainly low-cost index funds with expense ratios that are much lower.

Beyond saving money on the expense ratios, I also would love to save money on the administration fees I pay in order to invest. My company 401(k) has fees just under 1%, which is way too much for my tastes. I’ve stopped investing there first since there is no company match.

This past week I was doing some research on the new slate of robo advisors that have popped up. One of them jumped out at me because the company is extremely affordable, but it also has shown some of the best results in the past couple of years. Not only do they invest your money for you in a slate of well-diversified ETF index funds, and rebalance your holdings on a regular basis, but they charge you a pretty minimal fee to do it.

This all sounded too good to be true, so I decided to do a full review of this new automated investing service called Axos Invest Managed Portfolios, to see what they are all about.

Quick Navigation

Axos Invest History

Axos Invest launched several years ago under the name WiseBanyan. They had the goal of being the world’s first completely free financial advisor.

Here’s their reasoning behind why they launched their site.

Herbert Moore and Vicki Zhou founded WiseBanyan after seeing that the incentives between financial advisors and clients were often misaligned. They saw this firsthand while working in asset management and investment banking respectively, and later as colleagues at a quantitative asset management firm. They realized that the main cause of misalignment was a conflict of financial interests, which often resulted in high fees, unnecessary tax consequences, and unreasonable account minimums for the clients. As a result, they set out to build a company that was not incentivized to earn money at its clients’ expense.

WiseBanyan began with the idea that investing is a right – not a privilege. Our mission is to ensure everyone can achieve their financial goals, which starts with investing as early as possible. This is why there is no minimum to start and we do not charge high fees. We hope you are as excited about WiseBanyan as we are, especially what it means for you, your friends, and society as a whole.

Axos Invest was launched with the hope of making investing easy, accessible, and cheap – even for beginning investors who could only invest a small amount every month.

While the service is no longer free (They started charging a 0.24% annual assets under management fee in 2020), they still practice the values of making investing more accessible and affordable for everyone.

WiseBanyan Holdings was acquired by Axos Financial, and as of October 2019 and moving forward the company formerly known as WiseBanyan is now known as Axos Invest.

Axos Invest has become a part of the Axos Financial online banking platform. Check out our full review of Axos Bank.

Axos Invest Account Types – Managed Portfolios Vs. Self-Directed Trading

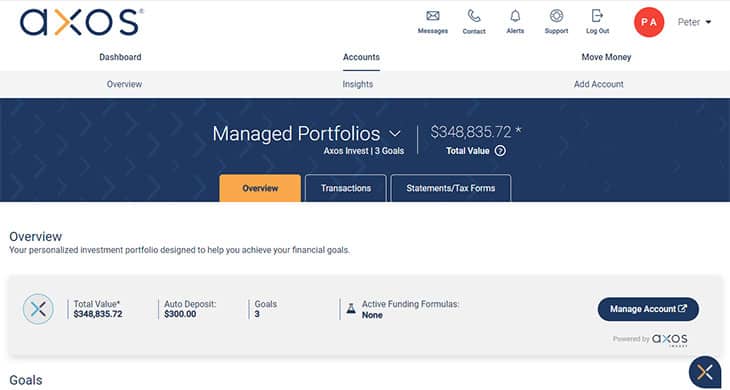

After reading up a bit about Axos Invest I was intrigued enough to sign up for one of their accounts. I went to their site to find that there are a couple of different account types you can sign up for.

I was mainly interested in signing up for Managed Portfolios since I intended to use this as a robo-advisor to automatically invest, rebalance and reinvest my dividends for me. I wanted it to be hands-off.

If you prefer to research and invest in your own choices of individual stocks, the commission-free Self Directed Trading account may be a better choice for you.

If you’re an advanced trader the Self Directed Trading account has the “Axos Elite” subscription which gives you real-time market data, TipRanks market research, extended trading hours, margin trading, stock lending, and more for a monthly fee.

Head on over to the Axos site via my exclusive invite link below to get started on your Axos Invest account now:

Open Your FREE Axos Invest Account Now

Open an Axos Self Directed Trading account and deposit at least $2000, and you’ll get a $250 bonus for a limited time!. Open Axos Self Directed Trading

Opening An Account With Axos Invest

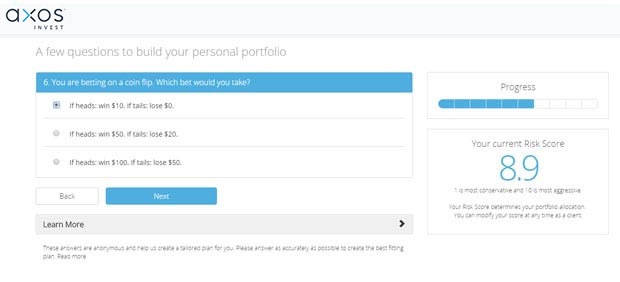

After going to the Axos Invest site to open my Managed Portfolios account, it dropped me right into a brief questionnaire to assess my risk tolerance, investment time horizon, and more.

While you’re answering the questions you’ll see a progress bar and a “current risk score” listed to the right, telling you just how conservative or aggressive Axos Invest believes you are.

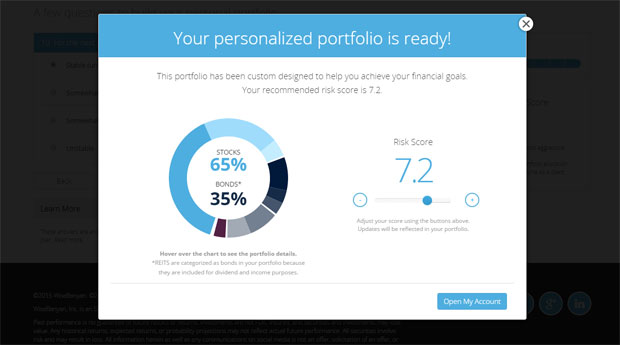

My risk score went up and down throughout the survey based on my answers, and when I finally completed it gave me a risk score of 7.2. That would give me an estimated asset allocation of 65% stocks to 35% bonds – which seems about what most would suggest as I’m relatively conservative in my investments, and the bond allocation roughly matches my age (put your age in bonds!)

I decided that I wanted to change my risk score and asset allocation to be a bit more aggressive, however, and you can do that simply by moving the slider to the right (or left if you’re more conservative). I ended up with closer to 75/25 stocks to bond allocation.

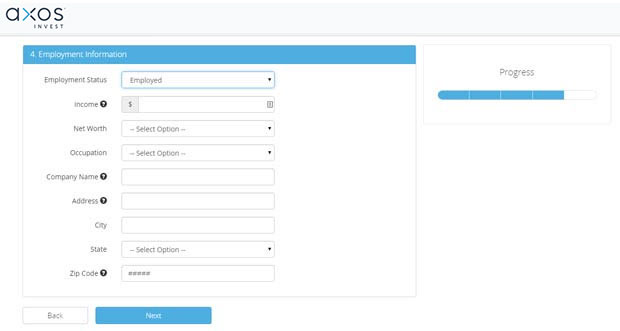

After completing the survey you click on the “Open My Account” button, which takes you into the account opening process. It will ask for all of your personal information including an email, password, employment information, and Social Security number (like you would have to at any brokerage).

Once you’re done entering your personal information you’ll be asked to choose an account type. Currently, you can choose:

- Taxable Investment Account

- Roth IRA

- SEP IRA

- Traditional IRA

After you choose an account type you’ll be asked to link a bank to fund your account. You can then choose to fund the account with as little as $500. If you want, you can also set it up to automatically invest for you every month. I have it set to automatically invest $300 for me on the 15th and 30th of the month.

Once you’re done your account will be sent to Axos Financial for approval. Their site says it takes about 5 business days for an account to be approved.

Axos Invest Investment Philosophy

Axos Invest will invest your funds based on Modern Portfolio Theory (MPT).

We use the tools of Modern Portfolio Theory to design the optimal portfolio for a given level of risk. In addition, we further optimize our investment process to minimize tax consequences and streamline the reinvestment of dividends and contributions.

Their investment philosophy is built upon four main pillars:

- The value of diversification

- Keeping fees as low as possible

- The value of passive investing

- Starting sooner rather than later

Axos Invest will attempt to give you a portfolio that is well-diversified, low-cost, and at low minimums so just about anybody can get started now. They’ll use the ideas behind MPT to give you the optimal portfolio for your given risk score.

The Actual Investments

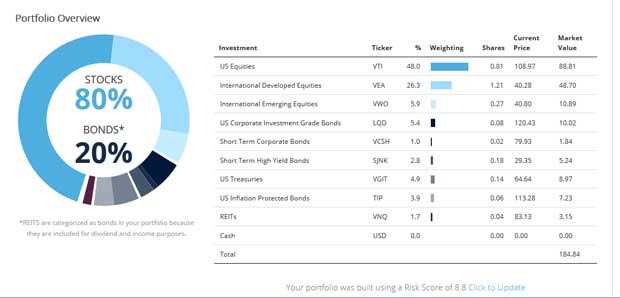

So what are you getting when you invest with Axos Invest? You’re getting a well-diversified portfolio that contains passively managed exchange-traded funds (“ETFs”).

The funds held with Axos Invest have an average fund fee of 0.12% – the only fees you’ll pay to invest. Here is the breakout for the individual funds they use (the funds used by Axos is subject to change, and probably will) and their expense ratios:

- Vanguard Total Stock Market ETF (VTI): 0.03%

- Schwab U.S. Broad Market (SCHB): 0.03%

- Vanguard FTSE Developed Markets ETF (VEA): 0.05%

- Schwab International Equity (SCHF): 0.06%

- Vanguard FTSE Emerging Markets ETF (VWO): 0.15%

- iShares Core MSCI Emerging Markets (IEMG): 0.14%

- Vanguard REIT Index Fund (VNQ): 0.12%

- iShares U.S. Real Estate (IYR): 0.42%

- iShares Investment Grade Corporate Bond ETF (LQD): 0.15%

- Vanguard Intermediate-Term Corporate Bond Index (VCIT): 0.05%

- Vanguard Intmdte Tm Govt Bd ETF (VGIT): 0.05%

- iShares Barclays TIPS Bond Fund (ETF) (TIP): 0.19%

- State Street Global Advisors Barclays Short Term High Yield Bond Index ETF (SJNK): 0.40%

- PIMCO 0-5 Year High Yield Corporate Bond Index (HYS): 0.56%

- Vanguard Short-Term Corporate Bond (VCSH): 0.05%

As you can see they have a broad diversification that also includes real estate via the Vanguard REIT Index fund, which isn’t something that Betterment gives you.

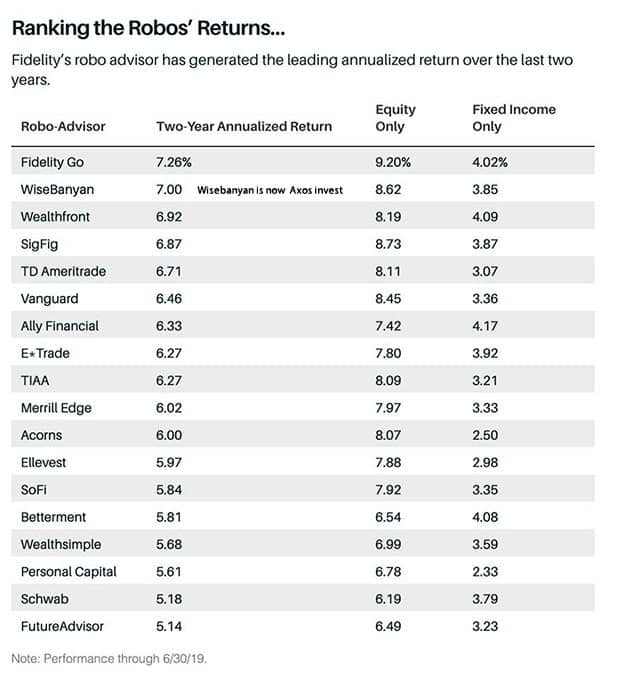

The performance of Axos Invest has been pretty good. As you can see from the screenshot from Barron’s “Ranking the Robos” article below, WiseBanyan/Axos Invest had the second-best two-year annualized return, through 6/30/19. Not too bad!

Axos Invest Mobile App

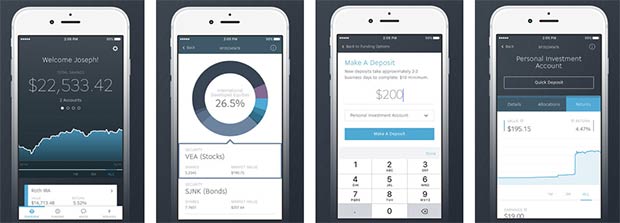

When the service first came out one of the complaints some users had was that there was no mobile app for the service. A mobile-optimized app for iOS was released shortly thereafter, as well as an app for Android users.

From the app, you can now do things on the go like check your balances, view your allocations, make a quick deposit, and more. The apps really are very pretty to look at and are a pleasure to use.

Axos Invest Fees & Account Charges

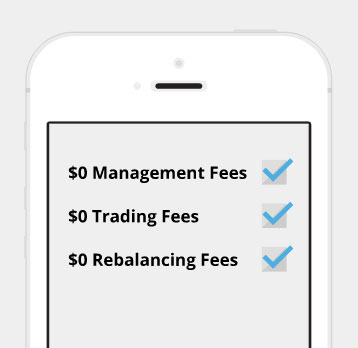

One of the biggest draws for Axos Invest when they started was the fact that they were essentially a fee-free service. While that is no longer the case, they are still very low-cost, one of the lowest-cost robo-advisors on the market.

Here are a few of the fees (or lack thereof) that you’ll see with the service:

Managed Portfolios

- Management fee: 0.24% of assets under management. Accounts less than $500 pay $1/month.

- Trading fees: FREE

- Rebalancing fees: FREE

- Dividend reinvestment fee: FREE

Self-Directed Trading

- Stock Trading fees: FREE

- ETF Trading Fees: FREE

- Options trading: $1 per contract

Self-Directed Trading – Axos Elite

Axos Elite is the premium self-directed investing service that offers more powerful investment tools, real-time market data, extended trading hours, lower fees, stock lending, and margin trading.

- Monthly fee: $10/month

- Stock Trading fees: FREE

- ETF Trading Fees: FREE

- Margin Trading: 5.5%

- Options trading: $0.80 per contract with Axos Elite

So essentially the Axos Invest service is very low cost with only the 0.24% AUM fee for Managed Portfolios. There are no trading fees, and no fees to rebalance your account or reinvest dividends. Competing services often charge much higher annual management fees, so with Axos being one of the very lowest when it comes to fees, you’re saving on those fees right off the bat.

There are some fees related to transferring funds via wire transfer, or do a full account transfer out, although regular electronic funds transfers (EFT) are free.

- Electronic Fund Transfer (EFT) fee: FREE for deposits or withdrawals.

- Wire transfers in: FREE (although your bank may charge).

- Wire transfers out: $30 per domestic wire transfer.

- Account closing fee: FREE.

- Full account transfer out fee: $75 per account.

- Partial account transfer out fee: $5 per security ($25 minimum/$75 max).

- Disbursement of funds by check by mail: $10 per check.

- Returned check fee: $40 per occurrence.

As mentioned above, Axos Invest’s product and service is very low cost and there are only a few small fees for certain types of transfers or check disbursements.

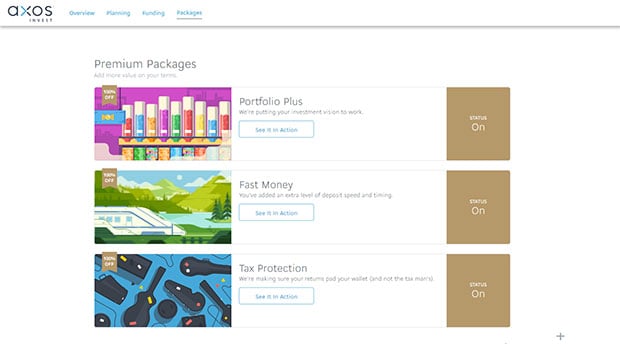

Premium Add-On Products & Services

There are several premium packages in your Axos Invest account that have a fee associated with them. You can turn them off and on whenever you want.

Currently, the premium packages include:

- Portfolio Plus: The ability to create your own custom portfolio from an expanded list of investments. You can choose from lists of different investment classes and types and add up to 20 investments to each portfolio you create. It costs $3/month to use this add-on package.

- Quick Cash: When activated this gives you quick same-day deposits, auto-deposit scheduler, and overdraft protection. It costs $2/month to use this add-on package.

- Tax Protection: This package will give you tax loss harvesting, selective trading (to remove ETFs you hold elsewhere to avoid the potential for wash sales) and IRAutomation, which helps you to maximize the use of your retirement account deposits, setup auto deposit plans and more. Each month the cost will be the lesser of 0.02% of your average Axos Invest account value (0.24% annually) or $20. So if you have $5,000 in your account, the monthly cost would be $1.

Using these add-on packages is purely optional, but even if you were to turn them all on it likely isn’t going to cost you more than a few bucks per month.

Axos Invest: Great For Cost-Conscious Investors

When I first read about Axos Invest I dismissed it out of hand because I thought that there had to be a catch somewhere, there’s no way they were offering this service for such a low cost when others are charging anywhere from .35%-1.0% annual management fees for similar services.

After looking into it further, however, it does truly seem like Axos Invest is committed to offering a low-cost investing service for both self-directed investors and those who want their portfolios managed for them.

Axos Invest does seem like a good option for newer investors. Not only can you start investing with no account minimums, and low management fees – but you can buy fractional shares with as little as $10 and get a highly diversified portfolio that should match the market in the long term.

The account has SIPC protection that covers up to $500,000 per client as well, so if Axos Invest were to go under you’d be covered.

I’ve signed up for my own Axos Invest account and have been with them now for years. They are my go-to recommendations for new (and even experienced) investors.

Open your own account below via my invite link.

Get Started With Axos Invest Now!

| Robo-Advisor | Assets Under Management (AUM) | Annual Fee | Account Minimum | Bonuses | Review |

|---|---|---|---|---|---|

| Betterment | $15 billion | 0.25% of account balance. 0.40-0.50% w/ human advisors | None | Up to one year managed FREE | Review |

| Wealthfront | $12 billion | 0.25% of account balance | $500 | $5k managed FREE (Bible Money Matters readers) | Review |

| M1 Finance | $1 billion | FREE (fees for add-on services) | None | Review | |

| Blooom | $3 billion | $10/month any account size | None | FREE 401(k) Checkup | Review |

| Axos Invest | $153 million | 0.24% of account balance. | $500 | Review | |

| Acorns | $1 billion | $1/month under $5k. 0.25% of account balance above $5k. Free for college students. | None | Review | |

| Public | FREE | None | Free stock up to $15 | Review | |

| Stash Invest | $600 million | $1/month under $5k. 0.25% of account balance above $5k. | $5 | $5 New Account Bonus (Bible Money Matters readers) | Review |

| SigFig | $120 million | Under $10k FREE; 0.25% of account balance above $10k | $2,000 | ||

| Personal Capital | $8.5 billion | 0.49% to 0.89% of account balance | $25,000 | Review | |

| Wealthsimple | $5 billion | $0-$99,999 0.50%/yr; $100k+ 0.40%/yr | None | Up to $10k managed free (Bible Money Matters readers) | Review |

| Charles Schwab | $15.9 billion | FREE (They require you to hold 6-30% of portfolio in cash) | $5,000 | ||

| Fidelity Go | N/A | 0.35% of account balance; | $5,000 | ||

| Vanguard | $101 billion | 0.30% of account balance | $50,000 |

I continually read that not having a mobile app is a con. In this world, everyone feels the need to be in constant contact with everything. I believe this is a pro and not a con. This is investing not trading. There is no reason to feel the need to check on the balance every day or for some multiple times a day. It would be best if they only looked monthly or even less. This is the type of account that you set and forget and let time and compounding work their magic. If you want to be a trader and not an investor there are plenty of other options. I am also concerned about the free platform and how long it can last but they are SIPC covered so if they would go out of business my investments are safe. If anyone wants to try them out and avoid the waiting list here is my referral link. https://axosinvest.com/r/qSrQy7AmY. I used one to avoid the waitlist to join.

Here is an update on my Axos Invest account. I started with the minimum opening balance and have deposited the minimum amount each month since Sept. 2015. I don’t know much about this stuff and didn’t want to lose any large sums of money. I’m happy to report so far it has had a return of over 5%. Its not perfect, but when there are no management fees it’s not bad. If your interested give it a try.

Very happy with with the service provided! No need for a mobile app, if I want to see how the account it doing I just log in at home. No need to check while at work or out in the town.

Hey Peter,

any update on the account? Thinking about investing 5k into a robo

I currently have $4280 invested with Axos Invest in my Roth IRA there. The returns are around 1.2%, which I think is about what the markets as a whole have been over the same time period. I’ve been happy with the service, especially with the zero costs I’ve incurred for using them. I’d still recommend them.

If you’re interested in Axos Invest, you can read more about my “Digit and Axos Invest Experiment” here.

Thanks for your reply. Appreciate it. I think I will give them a shot.

I signed up in June 2016. I didn’t chose the aggressive investor option. I just wanted to test the waters to see how the service is, so I decided to reach a milestone of $5000 in 18 months – a 70/30 mix. Currently I have a return of 4.4% and in a couple of months I will reach my goals. My question is that during tax season, do I have to include this in my tax returns?

It all depends on what type of account you opened, whether you’ve sold the investments or not, etc. I’d recommend speaking with a tax professional to figure out what you’ll need to claim in your situation.