If you’ve ever run into a situation with your bank where you have been assessed an overdraft fee for an innocent mistake in balancing your checkbook, you’ll appreciate a new financial app and spending account from Chime.

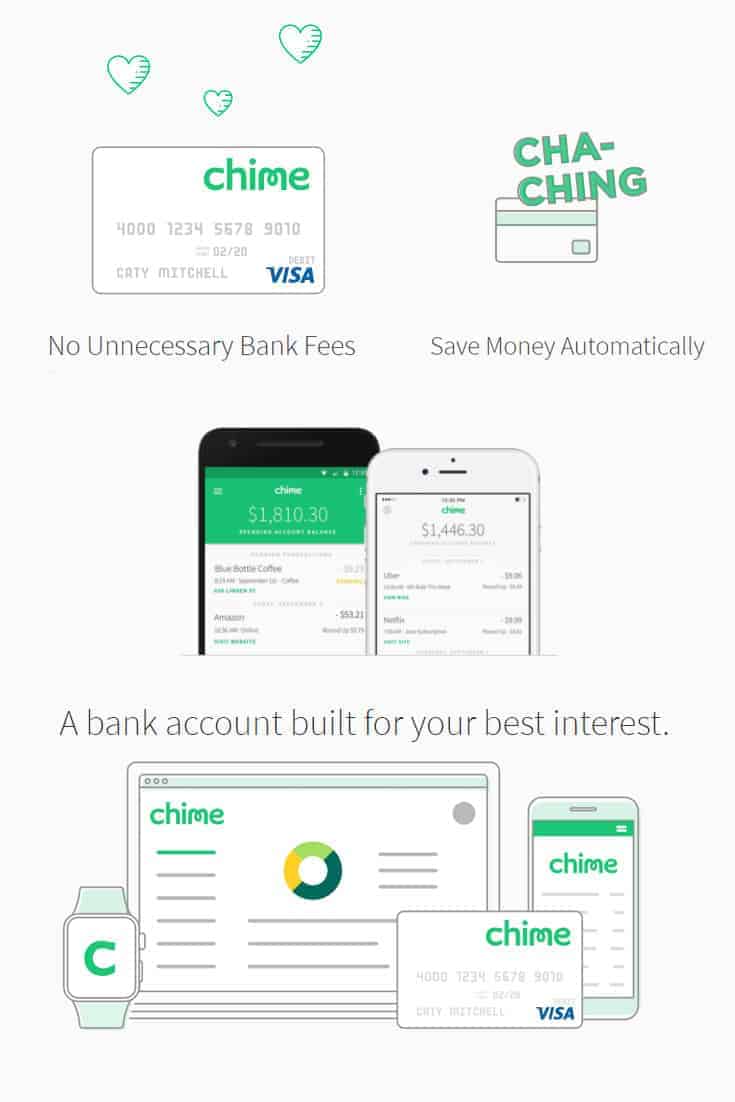

Chime believes that financial companies shouldn’t be making money off of your misfortune, and as such, they charge no maintenance fees, no overdraft fees, and no bounced check fees for their spending account. They even allow you to use over 24,000 ATMs for free.

But it doesn’t stop there. Not only is Chime fee-free, but it also has a rewards program that gives you the incentive to save.

So let’s take a look at what Chime has to offer.

Quick Navigation

Chime History

Chime app has been around for a while now, co-founded by Chris Britt and Ryan King in 2013. The company has raised over $12 million in venture funding.

Chime uses a banking partner, the Bancorp Bank, and Stride Bank. Those banks provide private-label banking solutions to a lot of financial services like Chime, Simple, and others. They provide the banking back end, while the front end brand, presence, and software are created and maintained by Chime.

The company was founded with the idea of empowering people to make better financial choices. From their about us page:

We created Chime for one very powerful reason: to empower people to lead healthier financial lives. Sounds simple, right? But it isn’t. Managing money is hard, and too often banks aren’t making it easier. At Chime we’re dedicated to building a new kind of account that helps members get ahead by making the hard parts of managing money easy. How do we do this? By eliminating unnecessary fees and creating a service that puts members in control, helps them form healthy habits, and empowers their financial well-being.

Most bank accounts cost you money. We designed Chime app differently, with a business model that doesn’t rely on fees to make a profit. Instead, Chime earns a small sum from Visa on Chime card transactions. So the more members spend, the more money we make. We share some of those earnings with our members so that the more you use your card, the more money you save. It’s a win-win.

Chime was founded to help encourage you to make better choices like saving more and to reward you for doing so. So let’s take a look at how Chime does that.

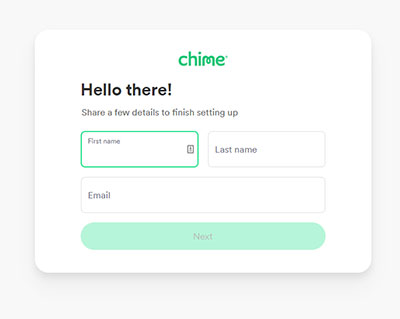

Signing Up For Chime (Get A $5 Bonus)

Chime is currently open for new users. Signing up for a free Chime spending account couldn’t be easier, and if you sign up through our link below, you’ll get a $5 bonus!

- First, Go to Chime via this invite link, and enter your full name, email address, and password.

- Next, enter the rest of your requested details.

- Link your existing checking account or set up a direct deposit to Chime.

Once you’ve set up your account it’s time to let Chime start working.

Chime Spending And Savings Accounts

So how does Chime work?

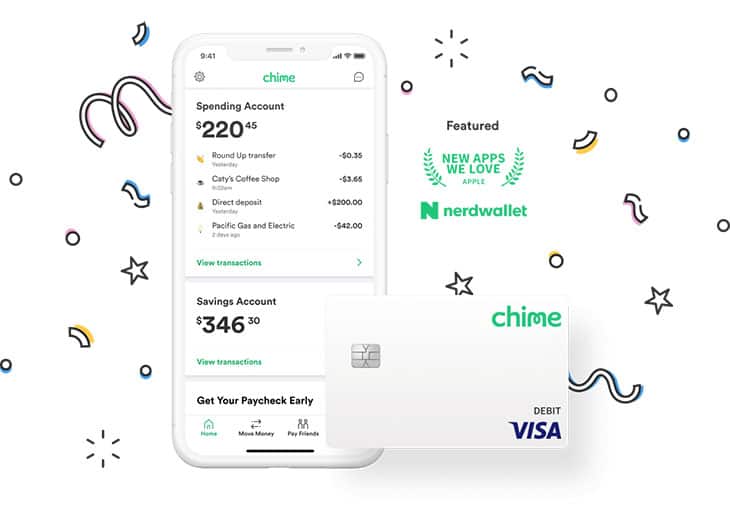

When you sign up for a Chime spending account you’ll receive a Chime Visa® Debit Card that you can use wherever credit cards are accepted. The debit card is linked to your Chime “spending account” (A spending account is like a checking account – but who uses checks anymore?).

If you want you can also open a savings account, which is needed if you want to enroll in their “Automatic Savings” rewards program (Trust me, you do. We’ll talk more about that below).

Safe and Secure

The Chime account is FDIC insured up to $250,000 through their banking partner The Bancorp Bank, and your account comes with the Visa Zero Liability policy for any unauthorized purchase.

Easy Direct Deposit Or Transfers

To fund your account you can easily set up a direct deposit of your paycheck when you sign up. Simply provide your Chime routing number and spending account number to your employer or payroll provider and they’ll set it up to fund your account automatically when your paycheck comes through.

If you prefer you can also initiate a transfer from an existing external bank account to be sent to your Chime spending account. If you initiate a transfer from your Chime account, there are limits of $200 daily or $1,000/month, so transferring from the external bank is probably preferable.

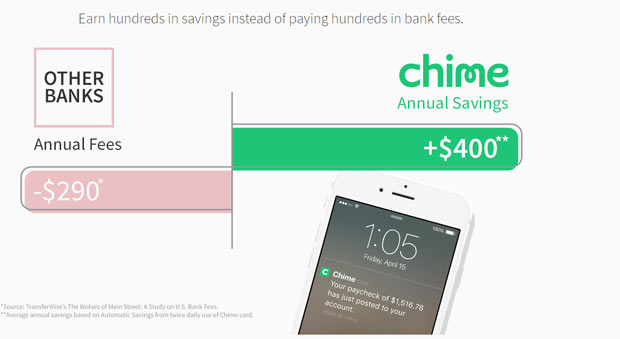

Fee Free Account

Chime app accounts are as free of fees as you can get. They charge no maintenance fees, no overdraft fees, and no bounced check fees. Banks in the U.S make billions off of fees every year, in fact, Americans paid $33 billion in overdraft fees last year! One study of U.S. Bank fees found that the average annual fees for an account holder were about $290. By not having fees like the ones mentioned, you’re already ahead of the game.

Americans paid $33 billion in overdraft fees last year. Chime might be part of the solution.Click To TweetWhat fees does Chime charge? Chime charges a $2.50 out-of-network ATM fee. That’s it.

Using Chime Via Mobile

Chime works well on both desktop and Mobile, but since the financial app is optimized for millennials, it works the best on your smartphone, either iOS or Android.

The app has mobile notifications set up so that you can get daily balance notifications, as well as real-time notifications of spending on your account.

You can also use the app to find local ATM locations and to get instant cash back at some retailers.

You can also block your card temporarily in the app if you’ve misplaced it.

Automated Savings Program

One of the most exciting features of a Chime account is the automatic savings component of the account. So how does it work?

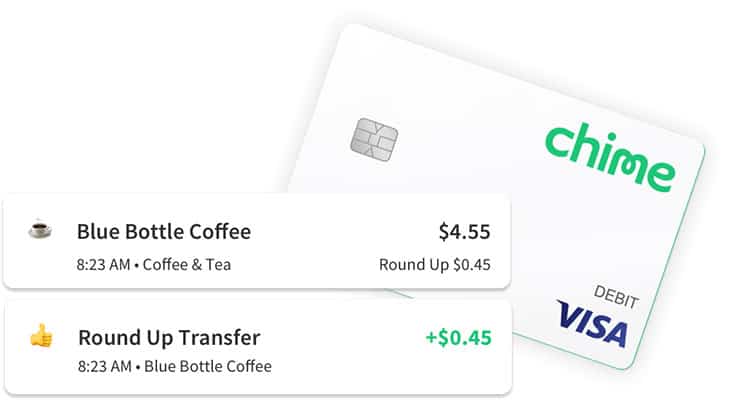

When you use the Chime debit card they will round up every transaction to the nearest dollar, and put the money aside in the savings account for you.

The savings account has a 2.00% APY1 (variable and may change at any time), which is in line with other competitive online savings accounts, and the rewards and automation of savings only make it that much better.

So if you do a transaction for $1.55, it will round it up to $2 and move .45 cents in your savings account.

Plus they now have a new tool that allows you to automatically put 10% of your paycheck aside when the money hits your account.

Chime: Give Your Savings A Bump

Chime is an interesting banking app option, that could be useful for a lot of people. I’m a big fan of products that take important ideas – like saving for the future – and make them easier and more automatic.

With the automatic savings program, Chime makes saving money pain-free and easy. Tools to help you save automatically when your paycheck hits your account are a bonus.

Is Chime for everyone? Maybe not. They do have some limitations at this point including lower limits on transfers initiated from your Chime account, and limits on transaction amount for the Chime Checkbook ($5,000/transaction or $10,000 per month). They also don’t do joint accounts currently. If you can get beyond those things, however, I’d recommend giving Chime App a try.

What have you got to lose? It’s free – and if you sign up now through the Bible Money Matters link below, you’ll get a $5 opening deposit!

Start Saving Automatically With Chime App. Get Your $5 Bonus!

Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

1The Annual Percentage Yield (“APY”) for the Chime Savings Account is variable and may change at any time. The disclosed APY is accurate as of November 17, 2022. No minimum balance required. Must have $0.01 in savings to earn interest.

| Micro Saving/Investing Site | Fee | Account Minimum | Bonuses | Review |

|---|---|---|---|---|

| Public | Tip Model (Free?) | None | Free stock | Review |

| M1 Finance | FREE (fees for add-on services) | None | Review | |

| Robinhood | FREE | Free stock | Review | |

| Dobot | FREE | None | $5 New Account Bonus (Bible Money Matters readers) | Review |

| Qapital | $3/month | None | $5 New Account Bonus (Bible Money Matters readers) | Review |

| Acorns | $1/month under $5k. 0.25% of account balance above $5k. Free for college students. | None | Review | |

| Chime App | FREE | None | $5 New Account Bonus (Bible Money Matters readers) | Review |

| Stash Invest | $1/month under $5k. 0.25% of account balance above $5k. | $5 | $5 New Account Bonus (Bible Money Matters readers) | Review |

| Digit | $5/month | None | Review | |

| Twine App | FREE for cash accounts. 0.60% of account balance for investment accounts. | $5 | $5 New Account Bonus (Bible Money Matters readers) | Review |

This sounds amazing, do you know if this available in Canada?

I checked their FAQ and it says,

So I’m assuming that means Chime is not open to residents of Canada at this time. Sorry, I guess living north of the U.S. Border means you can’t have nice things. :(

I’ve been using Chime for over 2 years now and for a good part of that they were my main bank. I never really had any issues with them. Now they are used as my secondary bank for transferring funds and savings. Love them

Although, chime is a fee-free bank and you receive early direct deposits, their customer service is horrible! I’ve been a customer for about 6 months. I found out on Monday, while trying to purchase food for my family at walmart, that my card and funds were blocked due to an unauthorized charge I have no knowledge of. It’s going on day three of this so-called investigation and no one is able to give me any answers. All of my funds are tied up in this investigation and I have no way to access it. I am one disgruntled customer and I don’t recommend this bank to anyone. It’s still much for them to learn about serving others.

Hi Charlotte,

We’re very sorry you had such a bad experience. Our system automatically flags any suspicious activity connected to your account, and that seems to be what happened in your case. Someone from our team has reached out to you to resolve the issue.

Again, we’re very sorry for the experience you had and hope to resolve this for you as quickly as possible.

– The Chime Team

Why has no one reached out to me. I can’t access my money. My hard earned money. I can’t eat, I can pay for my school books. I can pay to get o work, I’m gonna lose my job. I can’t do anything.

Did you get it resolved ? I just opened an account and worried it will happen to me since i shop a lot online.

Just pray you never have any problems. Four day waits for email support. 20 min waits on the phone. And when you do get a hold of someone either way, they either don’t know what to do and need to you call back, tell you it’s not their fault and hang up, or recognize that something is going on, but refuse to tell you what that something is and give you no solution.

And if you don’t use direct deposit, do not use this card. I’ve had an account with chime for a while and never had a problem, I loved my account in fact, until I switched to a job at a small business that writes paper checks.To deposit your check you have to: a. cash the check and then use a green dot to load it which can be expensive b. use a mobile app that charges you 5% of the check or you have to wait 8-10 business days to avoid the fee or c. use the worthless mobile deposit function which may or may not accept your check depending on how chime is feeling that day, then get the run-around on why the check was not accepted.

Hi Elizabeth,

Firstly, we’d like to extend our apologies for the frustrating experience you’ve had. We appreciate your feedback, and we’re taking steps to ensure this doesn’t happen again in the future.

We’re currently expanding our Member Services team, and we’re also working to improve our Mobile Check Deposit feature, which is currently still in beta. Thank you for your patience as we make these changes.

– The Chime Team

How do I transfer money from my account in the UK,to my sons account with chime in Fort worth,Texas

Hi Nancy,

We recommend using TransferWise to move money from your account to your son’s Chime account. Please don’t hesitate to reach out to support@chimebank.com if you have any further questions!

– The Chime Team

I have had nothing but a positive experience with Chime this is the best bank i have used in 30 years! The customer service is great. They responded promptly and although I was having trouble getting my retirement check direct deposit from CALPERS the staff at Chime were really understanding communicated promptly and helped resolve my problem to the absolute best of there ability. Way to go this is the future of banking.

Good Morning Mr Peter

Thanks for sharing positive insights about Chime.Can UK residents use this bank as the app is not yet available in the Uk?

Thanks

Best Regards

shola

I don’t believe it is available to UK residents yet. Thanks for stopping by!

Interesting business model. Hopefully it gains traction and people begin to save more and avoid those awful fees.

I absolutely LOVE this financial app! I’m wondering how old these other reviews are because everything must’ve improved since they all posted the negative reviews. I have used Chime for a couple of years now. I’ve never had even 1 issue at all. I even actually received the $50 referral bonus, as did the person whom I referred! When Wells Fargo, Bank of A etc etc all crash when their corruption catches up to them, branchless banks such as Chime will still be around. This was my incentive to switch to chime as it is. Also, they used to give you rewards and bonuses frequently, but I haven’t seen them lately. I’m thinking they’ll regret the ‘no fees’ deal soon, and as far as customer service goes, nearly everything can be handled via app or automated phone system. If it can’t be, all you have to do is say speak to an operator 3 times in the menu and you’ll be transferred to a person… Like the rest of the automated systems do. People just want to complain when they’re frustrated, and I understand that, but they shouldn’t be misrepresenting a company in reviews because they are upset at something that they could’ve prevented in the first place. Good job Chime!

I do not believe that another debit card was sent. I do not believe that an original debit card was sent.

I have seen reviews online and it seems chime is just terrible. You guys send generic messages and honestly don’t care about customers.

A real bank would make a way for someone to gain access to their money.

Let’s say that this next “Debit Card” doesn’t arrive, what does that mean. another 2 weeks without access to my funds.

I’m sure this is not the first time ya ran into this problem. I read about them from about 5 different websites.

You won’t get away with stealing from people. I’ve screenshot my account and warned other people, and ill be making facebook announcements because I refuse to stand by and let people get scammed. Its been an entire weekend, no one has tried to waiver the rules, and don’t tell me the rules are the rules because everyone knows there’s always someone to help out a little extra.

Give Me Access To My Money!!!

Watch how they reply with a generic message, saying “We deeply apologize, were working on “insert crap”…”

Don’t get this card! You can not talk to a live person. They are there to help out. This card is a joke and will let everyone know.

Never had any problems until last week. Deposits are late and now I can’t even login to the Chime app or online. Tried calling and get a “They are having technical difficulties” automatic voice response.

Consider your options before signing up for this card. Chime customer service is terrible. Don’t sign up for this card. If you ever have a disputed transaction, you’ll be waiting 2+ weeks for any communication, with no access to your money. This card used to be a suitable replacement to a traditional bank, it is not, I repeat, NOT a suitable replacement. Use any of your other options before Chime.

How about reporting fraudulent use? I am having an issue with being able to contact my bank about a fraudulent transaction that is now being processed.

Does anyone in authority read and respond to the negative comments? I am trying to decide if this bank is a good and reasonable option.

Chime is the best ever I’ve been with chime since 2018 and no issue and I love the credit builder