A while back I wrote a review of Wealthfront on this site, and also picked them as one of my top 5 robo-advisors that I recommend using.

Wealthfront has been one of the leading automated investing services since their inception, and over the past couple of years they’ve been adding new features at a furious pace in order to cement their position as the best one stop shops for all of your investing and financial planning needs.

This past month Wealthfront announced a new free financial planning experience for all users that should make their automated financial advice even more useful. They say it’s “a better way to experience financial planning“.

Today I thought I’d do a brief look at this new financial planning user experience and talk about why they may be just what you were looking for.

Quick Navigation

Wealthfront Free Automated Financial Planning

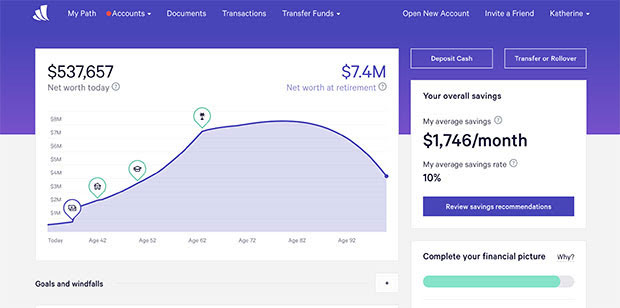

So what is the new free financial planning service offered by Wealthfront? At it’s most basic, it’s an automated financial planning user experience that all Wealthfront clients see every time they log in. The tools will ask you some questions about yourself, allows you to connect to all of your external checking, savings and investment accounts within the tool, and then it will help you to determine just how much you’re saving and spending. It will then show you what that means for your ultimate retirement goals, and help you to create what-if scenarios, and ask questions like:

- Can you live the lifestyle you enjoy now, in retirement?

- How much will you be worth in retirement?

- How much should you be saving today in order to reach your goals?

Wealthfront’s Portfolio Review tool is now built into the financial planning experience as well, and it will help you to analyze your outside investment portfolios and brokerage accounts and give you a set of recommendations as to how to improve your returns.

It’ll help you to check your investment accounts to make sure you’re not paying too many fees, that your investments are tax efficient, that you’re not carrying too much cash and that your investments are sufficiently diversified.

Assess Your Financial Health

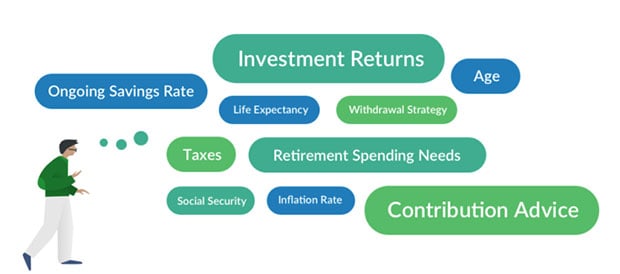

Many people don’t really know what their financial goals should be, and aren’t even sure how to figure out if the goals they set are even attainable with their current levels of spending and saving.

The planning tools are built to take a lot of the guesswork out of calculating your financial future, by doing a lot of the difficult work in figuring out what social security income you can expect, calculating inflation levels, expected investment returns and so on. Then it takes advantage of the ability to connect to your outside accounts to assess what your current financial situation actually is. What can you do based on where you currently are?

Setting Up The Free Financial Planning Tools

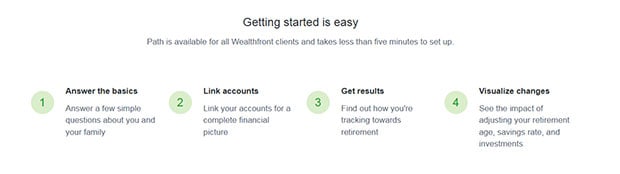

When you first start setting up the financial planning tools it will take you 5-10 minutes to enter information requested by the system.

- First, answer some basic questions about you and your family.

- Next, link your outside accounts to give Wealthfront a complete financial picture.

- Third, find out how you’re tracking towards retirement.

- Finally, visualize how changes you could make will affect your future.

Once you’ve done the basic setup required by the tools, the system will do a basic assessment of your financial health, and help you to get an accurate picture of what you can expect given your current levels of spending and saving.

Focus On What You Can Control Today

Once you’ve looked at your current situation and where you are, the system will help you to visualize how small changes in your saving or spending today, can mean big changes in your retirement accounts down the line.

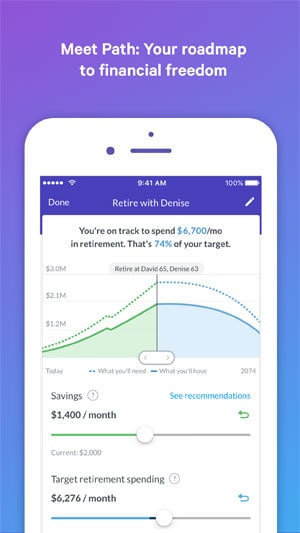

The free financial planning tools, which can be accessed on the website or via a fully mobile experience in the app, will give you a visual representation of how changes in your savings or spending can affect your retirement account balances.

Try Some What-if Scenarios

Sitting on the train on your way into work and thinking about your future? You can jump into the app and do some what-if scenarios with the handy sliders.

- What if I bump up my monthly savings by $100? What will that mean for my retirement savings?

- What if i get a big raise and promotion? Will that mean I’ll be able to spend a lot more than I thought in retirement?

- What if I have more kids than we anticipated, would it mean that I have to work a few extra years?

- What can I do to close the retirement gap between what I want my monthly spending to be in retirement, versus what will be attainable at current savings levels?

Get Recommendations Of Where To Allocate Savings

- It prioritizes contributions in tax-advantaged, low fee accounts.

- Uses your age and income to assess eligibility and contribution limits for each account type.

The planning tools will give you advice that fits your situation. Would you be best served to put half of your money in a company 401k, and then a quarter in a Wealthfront IRA – and a quarter in a taxable account? You’ll get those recommendations and you can plan accordingly.

It will take in the data, crunch the numbers, give you recommendations, and you can move forward how you would like.

Home Planning Advice

The financial planning tools will bring clients out of the window-shopping phase of home buying and into planning and saving with the help custom advice and recommendations.

Wealthfront uses third party data on home prices and mortgage rates combined with your financial information to provide an accurate estimate of what you can expect to afford when ready to purchase a home — whether it’s six months or five years from now. Their home affordability estimate even accounts for expenses beyond the mortgage, such as closing costs, property taxes, maintenance, and insurance

College Planning

Wealthfront also just launched College Planning within their financial planning tools. With the college planning tool, Wealthfront will walk you through every important aspect of college planning and deliver a complete, personalized assessment.

How Does it Work?

- Choose a college – Wealthfront connects to every U.S. college for real time expenses that include tuition, room and board, books, etc. You can change the school you’re building towards at any time and the data will update automatically.

- Wealthfront Calculates Financial Aid – Using outside data around the costs of a particular college and their specific approach to calculating financial aid, along with the personal details that you’ve shared through the tools, Wealthfront will provide a customized estimate of financial aid per school.

- Watch Your Savings Grow. Choose how much you can save, and it will show you how far that will go towards covering college expenses. Just like with retirement, you can adjust the inputs to see the impact of increased savings.

With the addition of College Planning, Wealthfront is now the only advisor who can deliver the most cost-effective 529 AND a personalized college planning solution all in one.

Time Off for Travel

Wealthfront also offers Time Off for Travel, a new financial planning service that lets clients explore the possibility of taking an extended leave. With Time Off for Travel, Wealthfront’s advice engine provides answers to questions like:

- How much time can I afford to take off? Once a client links all their financial accounts, Wealthfront estimates how many months or even years they can afford to travel. Wealthfront even takes combined household finances into account.

- How much will I spend while traveling? Wealthfront estimates how much a client is likely to spend while traveling based on their current personal spending habits and how they plan on traveling from budget to luxurious.

- Will taking time off impact my other goals? With Wealthfront’s unique affordability slider, a client can see if taking extended time off will delay their ability to buy their dream home or retire early. Advice is always delivered in the context of a client’s other plans so a single goal doesn’t disrupt one’s entire Path, or financial plan.

- What can I do to afford to take time off? Wealthfront provides advice on how a client might adjust their spending, saving or other goals to afford an extended leave from work.

Other Recent Wealthfront Updates

The offering of free financial planning tools isn’t the only place Wealthfront has been innovating. There are a slate of new features and functionality that they’ve released recently.

- Wealthfront Cash Account: Wealthfront’s new high-yield cash account offers an interest rate of 2.57% and is FDIC insurance for up to $1 million. That’s nearly 20 times the national average interest rate and four times the insurance you’d receive at a traditional bank. You can open a cash account with as little as $1. The account isn’t subject to any market risk and offers unlimited and free transfers all for no fees.

- The Wealthfront 529 College Savings Plan: College savings plans based on over 20 different “glide paths”, tailored to match both the beneficiary’s age, as well as the account owner’s financial situation and risk tolerance. As you get closer to the child’s college years, the assets are continuously allocated to suit where you are.

- Tailored Transfers: Instead of selling everything at once, use Wealthfront’s tailored transfer process to migrate your investments tax-efficiently over time.

- Stock-Level Tax-Loss Harvesting: An enhanced form of tax-loss harvesting for accounts over $100k to boost your tax savings. Wealthfront is the only automated investment service to offer Stock-Level Tax-Loss Harvesting.

- Smart Beta: Smart Beta is Wealthfront’s improvement on existing Smart Beta ETFs. Wealthfront has implemented a multi-factor investment strategy combined with its Stock-Level Tax-Loss Harvesting feature, which adds a level of tax efficiency not found in existing Smart Beta ETFs. The feature is offered to clients with $500,000 or more at no incremental cost above the 0.25% advisory fee.

- Risk Parity: Available for an additional 0.03% to taxable accounts over $100,000, Risk Parity is an alternative methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory (MPT), also known as mean-variance optimization. Historically, Risk Parity has generated better returns for a given level of portfolio risk than the more common MPT.

- Portfolio Line of Credit: Launching on 4/28/17 this line of credit is available for any Wealthfront client with an Individual or Joint Wealthfront account valued at $100,000 or more. There’s no set up – if you’re an eligible Wealthfront client then you already have access. Your line of credit is secured by your diversified investment portfolio, so current rates are as low as 3.25-4.5% (lower than most HELOC loans) depending on account size. Borrow the amount you need (up to 30% of current account value), when you need, for whatever you want. Repay on your own schedule.

People are living busier lives than ever these days, and taking time out every 6 months or a year to visit a financial planner isn’t always feasible.

With Wealthfront’s new free financial planning tools you can cut out that middle man and get automated advice tailored to your specific situation, and get up and running with a plan of action in just a few minutes. Definitely worth checking out.

| Robo-Advisor | Assets Under Management (AUM) | Annual Fee | Account Minimum | Bonuses | Review |

|---|---|---|---|---|---|

| Betterment | $15 billion | 0.25% of account balance. 0.40-0.50% w/ human advisors | None | Up to one year managed FREE | Review |

| Wealthfront | $12 billion | 0.25% of account balance | $500 | $5k managed FREE (Bible Money Matters readers) | Review |

| M1 Finance | $1 billion | FREE (fees for add-on services) | None | Review | |

| Blooom | $3 billion | $10/month any account size | None | FREE 401(k) Checkup | Review |

| Axos Invest | $153 million | 0.24% of account balance. | $500 | Review | |

| Acorns | $1 billion | $1/month under $5k. 0.25% of account balance above $5k. Free for college students. | None | Review | |

| Public | FREE | None | Free stock up to $15 | Review | |

| Stash Invest | $600 million | $1/month under $5k. 0.25% of account balance above $5k. | $5 | $5 New Account Bonus (Bible Money Matters readers) | Review |

| SigFig | $120 million | Under $10k FREE; 0.25% of account balance above $10k | $2,000 | ||

| Personal Capital | $8.5 billion | 0.49% to 0.89% of account balance | $25,000 | Review | |

| Wealthsimple | $5 billion | $0-$99,999 0.50%/yr; $100k+ 0.40%/yr | None | Up to $10k managed free (Bible Money Matters readers) | Review |

| Charles Schwab | $15.9 billion | FREE (They require you to hold 6-30% of portfolio in cash) | $5,000 | ||

| Fidelity Go | N/A | 0.35% of account balance; | $5,000 | ||

| Vanguard | $101 billion | 0.30% of account balance | $50,000 |

Share Your Thoughts: