Launched in 1975 by the legendary John Bogle, Vanguard, is best known for its low-cost mutual funds. The company is the largest provider of mutual funds in the world, and the second largest provider of exchange traded funds (ETFs).

As one of the largest investment services in the world, Vanguard has over 30 million investors with more than $6.7 trillion in assets under management.

It’s not surprising then that Vanguard now offers both a “robo-advisor”, Vanguard Digital Advisor, and a live financial advisory service, Vanguard Personal Advisor Services.

What are these investment programs, and how can they work for you?

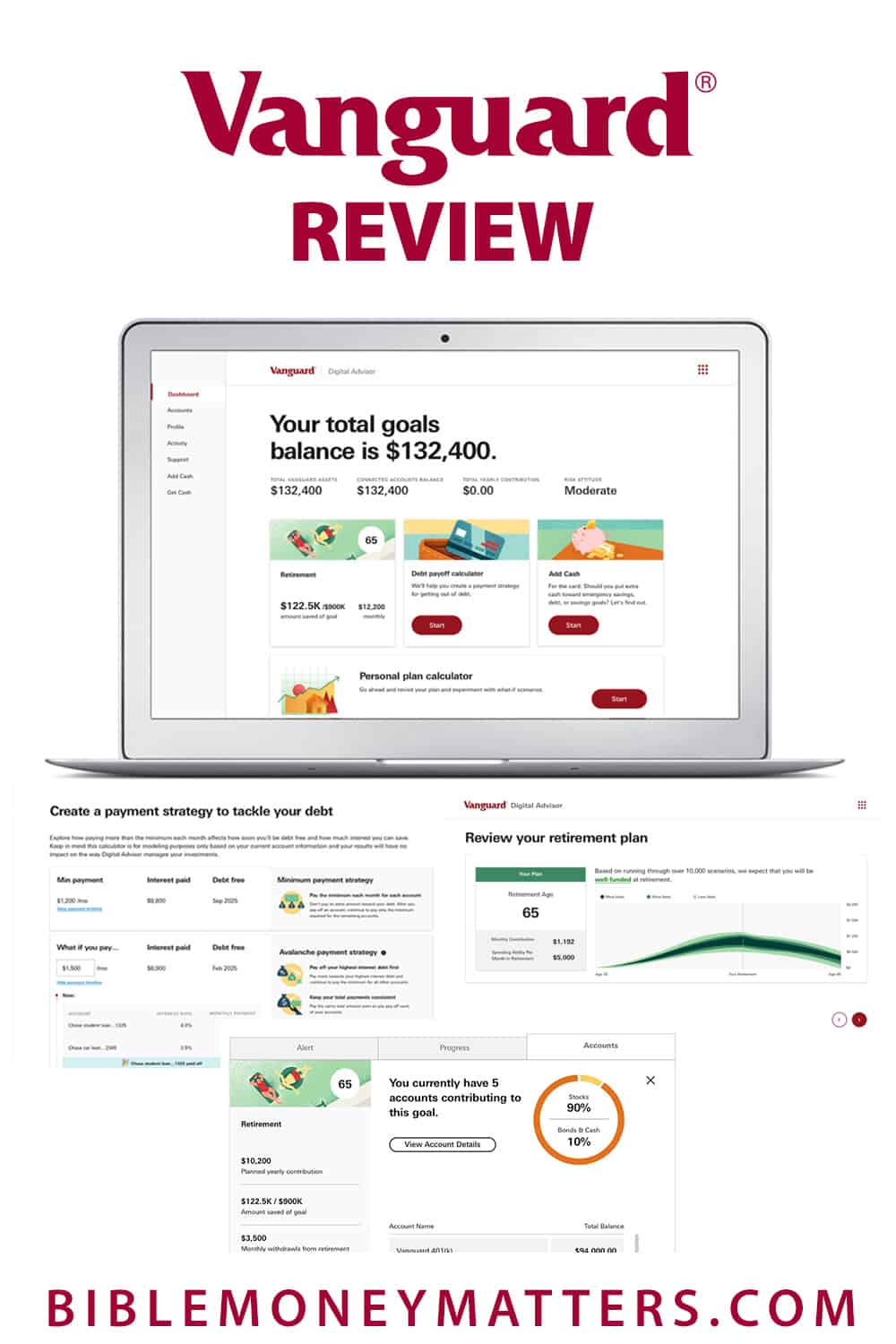

Vanguard Digital Advisor

Vanguard Digital Advisor is an automated, online investment management service, commonly referred to as a robo-advisor. It’s designed to guide you through establishing your own retirement goals and designing long-term plans to help you reach them.

But it goes beyond retirement planning alone. It will also help you to pay off debt, which will make it easier and faster for you to save money toward your retirement goals.

Vanguard Digital Advisor is designed for anyone who:

- Wants to get control of debt, while building wealth at the same time.

- Needs professional guidance to assist with making financial decisions.

- Prefers a managed investment option through an online platform.

Vanguard has designed the Vanguard Digital Advisor primarily to help those who are in the process of building their net worth for the future, as well as paying off debt. However, it’s not recommended for someone who is already working with a traditional financial advisor or is retired and already drawing down long-term savings for living expenses.

It’s also not recommended for anyone with a complicated financial profile. That can include someone in need of specific tax management strategies, wealth preservation, or estate planning.

Vanguard Digital Advisor Investment Management

When you sign up with Vanguard Digital Advisor you’ll complete a questionnaire designed to assess your risk tolerance. That’s basically how much risk you’re willing to accept in exchange for higher returns.

The risk range runs between conservative and very aggressive. The conservative portfolio allocation will primarily emphasize safety of principal, while a very aggressive mix will have a strong orientation in favor of growth. Other allocations will have a mix of both.

Once a portfolio allocation has been determined that’s right for you, Vanguard Digital Advisor will invest your money in a mix of high-quality, low-cost Vanguard ETFs.

Vanguard ETFs are some of the most popular in the investment world. They’re frequently included in the portfolios of other robo-advisors as well as traditional investment advisors and management services. A major reason for this inclusion by so many investment management services is low investment fees. These are referred to as expense ratios, and Vanguard funds typically have some of the lowest in the industry.

The average expense ratio on a Vanguard ETF is 0.10%, compared to an industry average of 0.57%. Since expense ratios are charged by a fund on an annual basis, they reduce the net effective return the fund produces. The smaller the expense ratio, the greater the return on the fund.

The use of ETFs will not only provide desired asset allocations, but also proper diversification between broad asset classes and individual securities. For example, a single ETF can hold hundreds or even thousands of individual stocks. The use of just a handful of ETFs can put thousands of stock and bonds in your portfolio.

Not only will the advisor adjust the strategy as your goals change, but also gradually move your portfolio from growth assets – stocks – to safer, interest-bearing bonds, as you move closer to retirement.

But Vanguard Digital Advisor won’t just be focusing on long-term savings for retirement. It also helps you to properly allocate funds for short-term needs, including emergencies. And when you have cash in excess of those short-term needs, it will help you decide if you should use the extra funds to pay off debt, or move them into long-term investments.

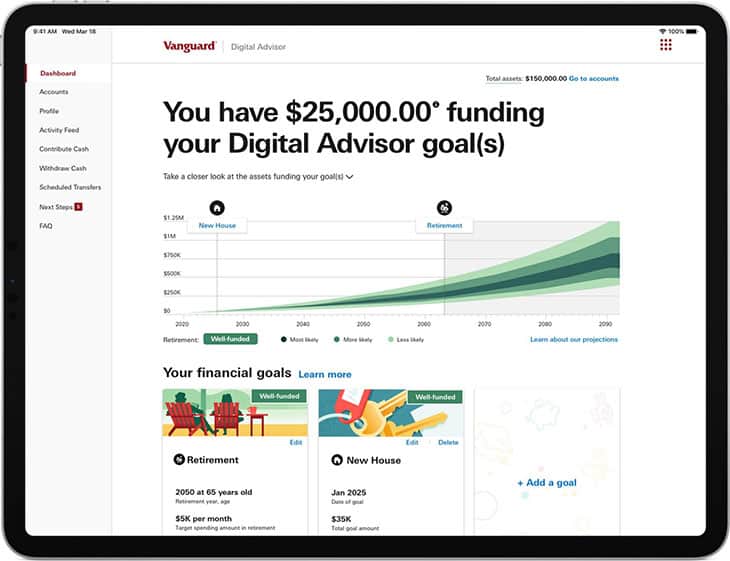

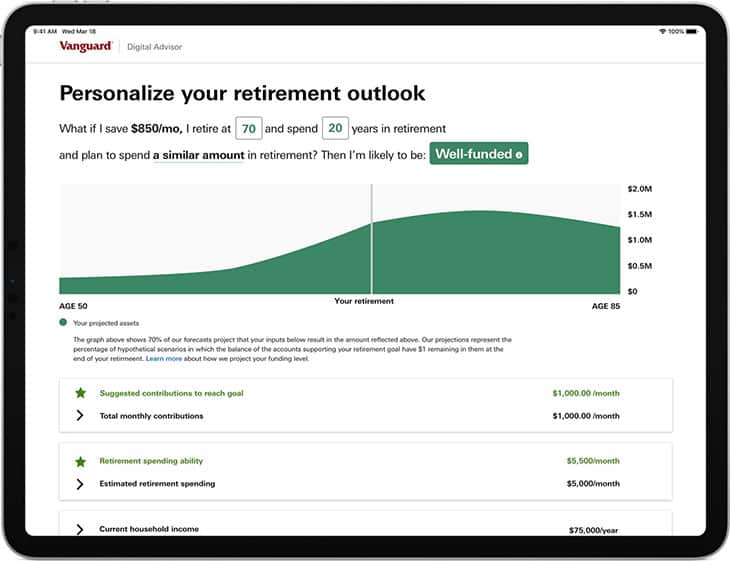

Vanguard Digital Advisor Retirement Planning Tools

In addition to providing investment management, Vanguard Digital Advisor also offers retirement planning tools. Those will enable you to experiment with different retirement scenarios.

For example, it will give you an opportunity to change certain variables, including your retirement age, savings goals, current income, and even future income and expenses.

Based on changes in any of the variables, Vanguard Digital Advisor will provide you with estimates of your future investment value.

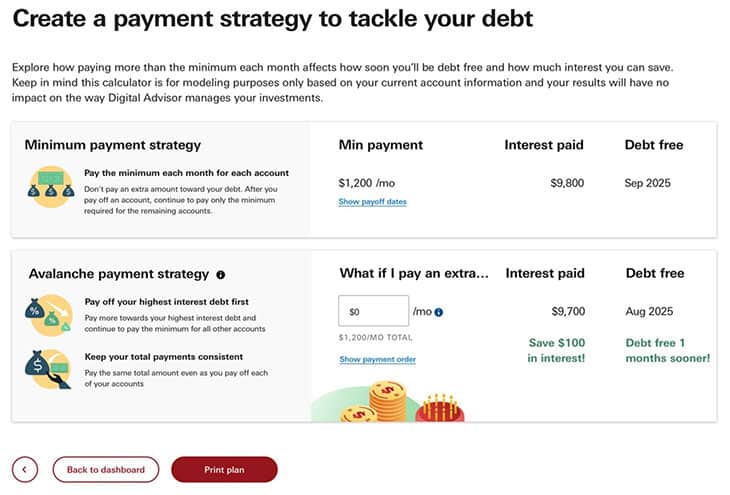

Vanguard Digital Advisor Debt Payoff Calculator

You can use the debt payoff calculator to run scenarios to help you pay off your debt in the shortest time possible.

For example, you can evaluate different debt payoff strategies, such as the “debt avalanche”. (This is the debt payoff strategy in which you emphasize paying off the highest interest debts first.)

You can also run scenarios to see how much more quickly you can pay off a debt – and how much interest you’ll save – by making higher monthly payments.

Vanguard Digital Advisor Minimum Investment and Program Fees

Vanguard Digital Advisor requires a minimum initial investment of $3,000. That will make it suitable even for smaller investors.

The annual investment advisory fee is 0.15%. That means you can have $10,000 account managed for just $15 per year, or $100,000 for just $150 per year.

The annual advisory fee is well below the robo-advisor industry, which ranges between 0.25% to 0.50%.

But it gets even better. Vanguard is offering Digital Advisor free for the first 90 days. They’ll give you an opportunity to “test drive” the service before you begin paying the advisory fee.

The 90-day fee waiver is available only for taxable individual accounts and individual IRAs. To take advantage, you’ll need to sign up for Vanguard Digital Advisor by April 30.

Vanguard Personal Advisor Services

Vanguard Personal Advisor Services is exactly what the name implies. It’s a service offering a combination of advanced technology, expert methodology, and trusted behavioral coaching to help investors achieve their long-term financial goals. It’s designed primarily for pre-retirees and retirees.

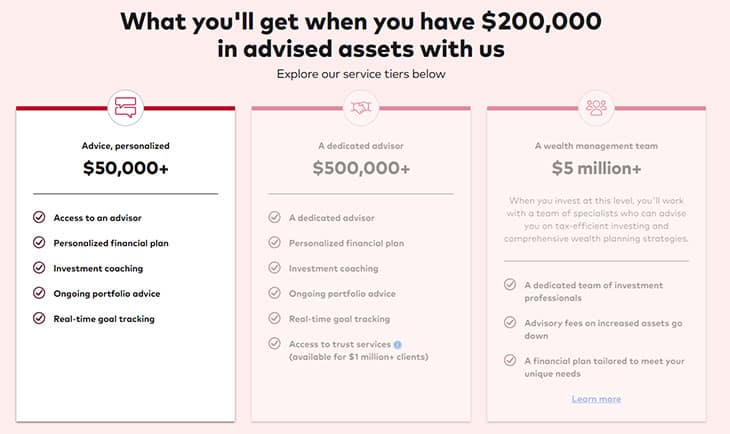

This starts with a professional financial advisor. You’ll have access to a team of financial planners if your portfolio is less than $500,000. But if it’s more, you’ll have a dedicated certified financial planner (CFP) to provide one-on-one financial advice.

Either service level will include scheduled consultations at your request, though accounts of $500,000 or more are offered regularly scheduled consultations.

What’s more, Vanguard’s financial advisors are fiduciaries. That means they’re required to always put the client’s interests before their own. That prohibits constructing or managing your portfolio in any way that will enhance fees paid to either the advisors or Vanguard.

In addition, financial advisors don’t earn commissions and therefore have no incentive to steer you into certain financial products based on the fees they might earn.

Portfolio management centers around tax efficiency and provides quarterly rebalancing to keep your portfolio consistent with your investment asset allocation targets.

Similar to Vanguard Digital Advisor, your portfolio will be invested in both passive (index-based), and active ETFs and mutual funds, with customized tilts.

Financial Planning Services

Beyond direct investment management, Vanguard Personal Advisor Services also offers financial planning services.

Those services include:

- A Social Security analyzer

- Dynamic spending

- Cash flow forecasting and success rates

- Emergency fund

- Healthcare cost estimator

- Estate planning

- Retirement goal planning

- Custom goal planning, such as saving for shorter-term needs

- Trust administration services for accounts of $1 million and higher (will be subject to an additional fee)

Vanguard Personal Advisor Services requires a minimum initial investment of $50,000. The fee structure starts out at 0.30% but works on a sliding scale based on portfolio size.

The fee structure is as follows:

- $50,000 to $5 million, 0.30%

- $5 million to $10 million, 0.20%

- $10 million to $25 million, 0.10%

- $25 million and higher, 0.05%

Vanguard Digital Advisor and Vanguard Personal Advisor Services – Which Will Work Best for You?

Which Vanguard service will work best for you will depend on your investment goals and the amount of money you have to invest.

Vanguard Digital Advisor is designed for smaller investors looking for long-term growth. It requires a minimum initial investment of just $3,000, which will make it attractive for both small and medium-sized investors.

Vanguard Personal Advisor Services requires a minimum initial investment of $50,000. That will make it more suitable for medium and large investors. Large investors may be particularly drawn to the service, given that the fee structure declines on larger portfolios.

Vanguard Personal Advisor Services will also be attractive for investors looking for more comprehensive financial advice. Vanguard Personal Advisor Services offers retirement investing as its core service, but also offers broad financial planning services, like estate planning.

A Vanguard Personal Advisor Services Fee Example

Typically, the level of service provided by Vanguard Personal Advisor Services would involve paying a fee of between 1% and 1.5% of your portfolio value to a traditional investment advisory service.

The difference between a 1% fee charged by a traditional advisor and the 0.3% charged by Vanguard Personal Advisor Services means you’ll be able to increase your investment return by 0.7% just by using the Vanguard service.

To illustrate the benefit, let’s look at the effect of both advisory fees on a $100,000 portfolio expected to produce average annual investment returns of 6% over 20 years.

With a 1% annual advisory fee, the net annual average return on the portfolio managed by a traditional investment advisor will be 5%. Over 20 years, your investment will grow to $265,329.

But if you invest with Vanguard Personal Advisor Services at an annual fee of 0.30%, the net annual average return on your portfolio will be 5.7%. Over 20 years, your investment will grow to $303,039.

That’s an extra $37,710 just for choosing to have your money managed by Vanguard Personal Advisor Services rather than a traditional investment advisor.

Vanguard Robo-Advisor: Good For Portfolios Of All Sizes

Both Vanguard Digital Advisor and Vanguard Personal Advisor Services are new products rolled out by Vanguard. But as one of the largest investment firms in the world, with nearly a half-century of investment experience, the newness of the two services isn’t the issue that it would be with the typical upstart.

Vanguard is one of the most trusted names in the investment universe, and its funds are widely used by robo-advisors, investment managers and many millions of investors around the world.

Adding investment management to the Vanguard family only makes a winning product line better.

Brokerage | Promotion | Open Account | Review |

|---|---|---|---|

2 free stocks (Up to $1,600) | |||

Free stock slice | |||

Free $10 bonus | |||

1 free stock (Up to $200) | |||

Get $100 when you deposit $2,500 | |||

Free stock (Up to $1,000) | |||

Get up to $1,000 cash to invest. | |||

2 free stocks (Up to $400) | |||

3 free stocks (Up to $1,200) | |||

Free $5 bonus | |||

Free $5 bonus | |||

Free $10 crypto bonus | |||

Free $250 bonus |

Vanguard Personal Advisor Services

Interestingly Vanguard are winding down their advisory services now. Must not have been that profitable!