Groundfloor’s website boasts an average historic 10% return.

How realistic is that?

Well, if you’ve ever seen one of those property flipper shows on TV, you already know how profitable that type of real estate investing can be.

If you’ve been biting at the bit to get involved in that action, but lack the capital necessary, Groundfloor provides a way for you to profit from the process and fractionally invest into real estate.

They make it easy, too, so please read on.

Quick Navigation

What Is Groundfloor?

Groundfloor is a fractional real estate investing platform, but one with a bit of a different twist. Instead of investing in large commercial real estate projects, they focus on providing loans to renovate or build single-family properties.

If you’ve ever seen HGTV’s Flip or Flop or Desert Flippers, you already have a general idea of the basic concept behind Groundfloor. Except that Groundfloor doesn’t do the actual renovations or build the properties themselves. Instead, they provide short-term financing to real estate entrepreneurs who buy the properties and renovate them.

Investors then buy shares of the renovation loans, and earn high returns on their money, with far less risk.

Groundfloor was founded in 2013 and is based in Atlanta, Georgia. The company is an online marketplace, bringing together investors and real estate entrepreneurs. Since its founding, the company has arranged over 5,800 projects, that have repaid investors over $1.6 billion. (as of Feb 2025)

The deals themselves are different from how most real estate investing platforms work. They do not focus on equity funding. Instead, Groundfloor arranges short-term financing to enable real estate entrepreneurs to engage in new construction, renovations, and ultimately, the flips. For this reason, investors’ money is tied up for far less time than is the case with other real estate investing platforms.

Groundfloor has a Better Business Bureau (BBB) rating of B (on a scale of A+ to F), where it’s been accredited since August 2015.

Groundfloor Awards & Mentions

Groundfloor has won quite a few awards and received mentions in a variety of hot tech company lists.

- Named on the Forbes Fintech 50 list.

- Ranked on the Inc 5000 list for five years in row, demonstrating strong, consistent revenue growth

- Ranked in Deloitte’s Technology Fast 500 list for four years.

- HousingWire Tech 100 Award

- Fintech Breakthrough Award for Best Crowdfunding Platform

- Benzinga Global Fintech Award for Best Lending Platform

- Benzinga Global Fintech Awards Finalist

- IMN Single Family Awards Finalist

- Atlanta Business Chronicle Pacesetter Award

- Technology Association of Georgia Top 10 Most Innovative Companies

How Groundfloor Works

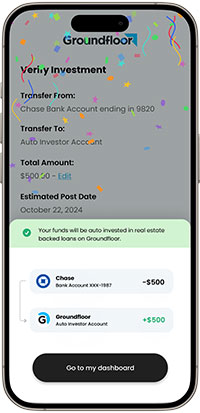

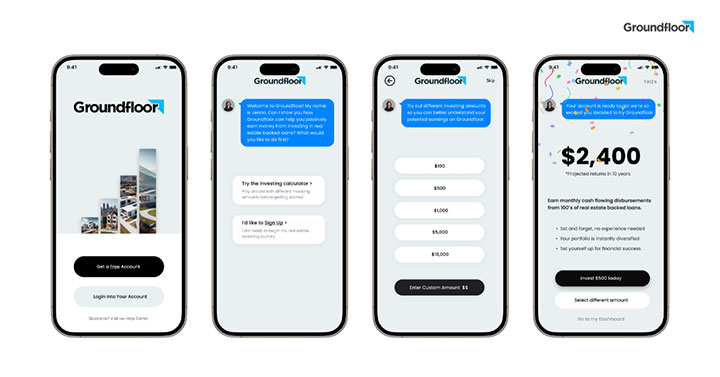

Groundfloor has a mobile-first approach. You can set up your account in minutes after downloading the Groundfloor mobile app, though you can also do this on your desktop or mobile browser. It will take you through a process to sign up for an account, link your bank account instantly and securely, and then transfer in funds so you can start to fractionally invest.

The entire process only takes a few minutes. After you set-up an account (it’s called an Auto Investor account), and transfer in a minimum of $100 from your bank account, you’ll be automatically and instantly invested into their flagship product called the Flywheel Portfolio. Groundfloor rolled out this product in October 2024 based on their years of investing experience across thousands of different loans and witnessing their investors’ behavior. The Flywheel Portfolio is qualified by the U.S. Securities and Exchange Commission. Structurally, it is a REIT but comes with many benefits that are not traditional for most REITs.

Groundfloor used to allow a more self-directed approach, but now that alternative investing has become more popular, they have automated the process. The Flywheel Portfolio combines 200 – 400 short-term real estate loans into a single investment opportunity. This approach greatly reduces risk and offers more stable and consistent returns. With the Flywheel Portfolio, investors get the added benefits of:

- Weekly disbursements as loans repay

- Instant diversification into hundreds of loans

- Set-it-and-forget-it, real estate investing

While in the app, you can see your portfolio’s health and summary, including the total number of loans you’re invested in, your accrued interest, your average realized returns, details of your returns, and more. The Groundfloor mobile app can be found in Google Play and the Apple Store.

When you invest in Groundfloor’s Flywheel Portfolio, you’re investing into hundreds of their short-term, high-yield loans. Most loans have a term of between six and 18 months. This is radically different from most real estate investment platforms that require you to remain in an investment for several years. As mentioned, with Groundfloor’s Flywheel Portfolio, you will see weekly payouts.

You don’t need to know all these specifics, but Groundfloor originates and asset manages all their loans. Loan parameters are as follows:

- Individual loans from $75,000 to $2,500,000.

- Loans can be up to 70% of “after repair value” (ARV) or up to 100% of loan-to-cost (LTC), depending on user experience.

- Must be non-owner-occupied properties only.

- Must be one to four-unit properties (no apartment buildings).

Since each loan is an investment in an individual property, the underlying real estate itself acts as security for the loan. In most cases, the loan you invest in will represent a first lien on the property. This is an advantage that’s unavailable with P2P loans, which are typically unsecured personal loans.

What are you actually investing in?

The loans in the Flywheel Portfolio consist of a variety of different fractional, real estate investments. They include:

“LROs”. Loan investments are referred to as limited recourse obligations or LROs. Each LRO is a slice of a loan and these make up the majority of your investment in the Flywheel Portfolio

Like other real estate investing platforms, Groundfloor subjects all loans to a strict vetting process. The types of projects include Purchase and Renovations, Refinance-Rehabs, Refinance-Cash Outs and New Construction. If you desire, you can see more granular details of each loan you’re invested in on your desktop view. But the beauty of the Flywheel Portfolio is that you are automatically invested and diversified across hundreds of projects at once.

Groundfloor does its due diligence, so by the time the loan is listed on the platform, you know it’s been given the once over. They evaluate each loan application to understand: How much skin does the borrower have in the game? What’s the loan-to-after-renovation value ratio? Does the borrower have a history on Groundfloor – have they had loans before and have they repaid?

The Groundfloor investor platform and mobile app allow you to track the progress of your investments, see your overall returns, and set your account settings so you can reinvest your reimbursements.

Both the return of your investment principal and accumulated earnings are paid to you when the various loans in the Flywheel Portfolio are paid back, and you’ll start to see the repayments weekly.

Groundfloor also offers a product called Notes. There are two types of Notes you can invest in, standard and Rollover Notes. Standard Notes come in 30-day, 90-day, and 12-month terms, while Rollover Notes come in 30-day and 90-day terms. One benefit of Rollover Notes is your ability to cancel your investment within the first 30 days. This offers liquidity whereas other Groundfloor products do not. With a Rollover Note, your principal investment is automatically reinvested to a new Rollover Note of the same duration, while you keep the accrued interest. However, all Notes require a higher minimum to invest: $1,000.

Of course, all investments have risk. Whenever you’re investing in real estate loans, there’s a chance the loan could go unpaid and go into foreclosure. However, Groundfloor puts itself in a first-lien position on its loans, to help mitigate risk for investors as much as possible. And because you are automatically diversified your principal risk is mitigated.

If a loan goes into default, Groundfloor also works to resolve the situation and works with the property owner to get the loan repaid. Finding a resolution first is the most important step for unpaid loans with Groundfloor. Foreclosure is a last-resort solution.

Fortunately, in many cases, defaulted loans still yield returns. The average return rate of defaulted loans on Groundfloor is 6%

Groundfloor Investor Requirements

Groundfloor accepts both accredited investors and non-accredited investors.

This is another departure from typical real estate investing platforms since many do require investors to be accredited.

since many do require investors to be accredited.

Basically, all you need is $100 to start investing with Groundfloor.

Groundfloor Features And Benefits

Minimum initial investment. The Flywheel Portfolio offers a minimum investment of just $100

Fees. Historically, Groundfloor did not charge fees to its investors. With the launch of the Flywheel Portfolio in October 2024, because of its industry-leading fractionalization and diversification opportunities, there is now a nominal fee for investors that is paid through your account’s repayments. (Meaning no upfront costs, think of this as an asset management fee).

- The fee is 0.25% of the disbursement. It’s important to remember that Groundfloor’s historical performance has yielded 10% across its portfolio. Thus this fee is still just a small amount to access these types of real estate returns.

Accounts available. Taxable investment accounts, plus traditional, rollover, Roth, SEP and SIMPLE IRAs, as well as solo 401(k) accounts.

Availability. Open to investors in all 50 states (since January 2018).

Dividend distributions. There are no dividend distributions. Both income and invested principal are returned as your share of each loan is repaid. This is unlike the way most real estate crowdfunding platforms function, in that Groundfloor does not provide monthly dividends.

Limited liquidity. Even though loan investments are short-term in nature, you will need to remain invested until the loan is paid out. Only one product, Groundfloor Rollover Notes, offers liquidity if you want to withdraw from an investment early.

Customer service. Available by phone or email, Monday through Friday, from 9:00 am to 5:00 pm, Eastern Time.

Platform security. To keep all information safe, Groundfloor uses encryption with an AES 256-bit symmetric key.

How To Sign Up With Groundfloor

To invest with Groundfloor you need to be at least 18 years old and supply the usual information required for any investment platform (name, address, email address, phone number, Social Security number, and any documentation required to prove your identity).

After you set-up your account, you’ll be asked to securely link your bank account. You may choose to do so automatically or manually. The manual process takes a few days longer to verify.

Once your bank account is linked, you can transfer funds into your Auto Investor account, which, as the name implies, will automatically disperse your funds into the Flywheel Portfolio, providing instant diversification and fractionalization. The most common transfer in deposits are $100 or $1,000.You’ll be able to view the progress of your investment in their dashboard and turn on various notification preferences in your settings.

Groundfloor’s funding account is non-interest bearing and is a service by Wells Fargo Bank. The account is covered by FDIC insurance, which covers depositors for up to $250,000. Funds can be transferred in by electronic transfer from your linked bank account. If you want to withdraw funds that are not at work, funds can be withdrawn from your account, but only to your linked bank account.

Refer Your Friends, Get Bonus Credit

Another nice thing about Groundfloor is their referral program. After you’ve signed up, if you like the service you can refer your friends and family to join you.

When the person you’ve referred signs up and transfers money into their account, you’ll each earn a bonus credit after 30 days.

A lot of referral offers have a limit to how many bonuses you can earn, but this one is nice because there is “no limit to the amount you can earn”. Just share your referral link from your dashboard and when they sign up using that link you’ll be in business.

Groundfloor Pros & Cons

Pros:

- Investment returns have averaged 10% per year.

- Loan terms are short – generally only six to 18 months. You receive repayments weekly.

- The minimum investment is just $100.

- Small, consistent fees.

- You do not need to be an accredited investor.

- Investments are secured by the underlying real estate.

- Automatic diversification and risk-mitigation through hyper fractionalization

- True set-it-and-forget-it passive income

Cons:

- Limited liquidity – you must maintain your investment until it pays out, unless you are invested in a Rollover Note.

- Groundfloor does not provide investment advice – you’ll be acting on your own information.

- There is a risk of loss of some of your investment principal. However, Groundfloor’s average return rate for defaulted loans is 6%, so you’re still likely to accrue interest for defaulted loans.

Should You Invest With Groundfloor?

If you’ve been bitten by the real estate investing bug, but don’t want to get involved in all the technicalities, complications, and costs that are involved, Groundfloor is the next best thing. You can serve as a lender to flipping or new construction projects, earn a healthy return on your money, and do it with limited funds and limited risk.

In addition to earning high returns on your investment, Groundfloor enables you to diversify your investment portfolio to include real estate. That can be particularly important, both as a long-term investment strategy, as well as a form of diversification away from an all-paper asset portfolio. Meanwhile, you can diversify across hundreds of loans with just a small amount of money, further reducing your investment risk.

An investment allocation in real estate, particularly in short-term projects like flipping, can enable you to earn high returns, even when other financial assets are not performing well.

If you’d like more information, or if you’d like to open an investment account, visit the Groundfloor website here:

| Crowdfunding Site | Fees | Account Minimum | Accredited Investor | Review |

|---|---|---|---|---|

| * Groundfloor | 0.25% | $100 | No | Review |

| * Fundrise | 1%/year | $10 | No | Review |

| * DiversyFund | None | $500 | No | Review |

| * RealtyMogul | 0.30% - 0.50%/year | $5,000 | No | Review |

| * stREITwise | 3% up front fee, 2% annual management fee. | $1,000 | No | Review |

| * FarmTogether | Intake fee of between 0.5% and 1.0%. 1% annual management fee. | $10,000 | Yes | Review |

| CrowdStreet | None | $10,000 | Yes | Review |

| Yieldstreet | 1-4%/year | $2500 | No | |

| Equity Multiple | 0.5% service charge + 10% of all profits | $5,000 | Yes | Review |

| PeerStreet | 0.25% - 1.0% setup fee | $1,000 | Yes | Review |

| Sharestates | 0-2% setup fee | $1,000 | Yes | |

| Patch of Land | 0-3% of loan total | $1,000 | Yes | |

| Cadre | Intake fee of between 1-3%. 1.5-2% annual management fee. | $25,000 | Yes | Review |

Share Your Thoughts: