Selling your home can be quite the undertaking, but with a bit of hard work you can end up with thousands more in your pocket. Here’s a list of things to consider doing when getting ready to sell.

What Factors Affect Your Property Taxes And How Much You Pay?

We’ve had a roller coaster ride when it comes to our property taxes over the past few years. So what are the some of the factors that affect your property taxes?

Mutual of Omaha Bank Mortgage Review

If you are currently looking for a mortgage or refinance, Mutual of Omaha Bank Mortgage is definitely worth a second look. Here’s my review.

Mortgage Modifications Without Documentation Of Hardship? Will It Lead To More Strategic Defaults?

The Home Affordable Modification Program (HAMP) allows homeowners to modify their home loan, as long as they could document a hardship. Now that requirement is going away. Will it lead to more strategic defaults?

Cutting Expenses, Increasing Income And Staying On Budget To Reach A Short Term Savings Goal

Sometimes in order to reach a short term savings goal you have to cut expenses, find ways to increase income and come up with a family budget that helps you to reach your goals.

How To Use Zillow When Buying Or Selling A Home

Over the years Zillow.com has become an essential tool for home buyers and sellers. Here’s why.

The Emotional Roller Coaster Of Building A New Home And Selling Your Old House At The Same Time

The process of finding a new place to call home, and selling your existing house at the same time can be extremely time consuming and emotionally draining, but potentially rewarding.

Buying Homeowner’s Insurance: What To Look For And How To Keep Your Rates Low

Homeowner’s insurance is an important piece of a financial plan, and is required by most mortgage companies. How do you ensure you’re covered and that you get an affordable rate?

The (Rock Star) Benefits Of Buying A Duplex

Making your first home a duplex (or other small multifamily property) can be extremely advantageous for you and your financial future. Here’s why.

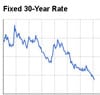

When Is The Best Time To Refinance Your Mortgage?

Have you refinanced your mortgage in the past year or so? If not, you may want to get started now, and here’s why…

How Much House Can You Afford To Buy? Should You Buy Less Than Your Means Allow?

How much house can you afford if you want to keep yourself in a sound financial position? How much should you spend if you also want to build wealth?

What Does It Cost To Sell A House? How Much Can You Expect To Pay In Fees, Commissions And Taxes?

When you add it all up, selling a home can cost thousands of dollars in commissions, fees, taxes and other costs. Here’s what costs to expect when selling your house.

4 Reasons Why You Might Have Problems Buying A House Despite Low Rates

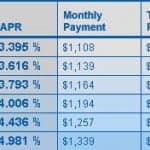

The economy is still in the doldrums, but one of the side effects has been that the rates on home mortgages are at their lowest levels ever. Last week 30 30-year fixed mortgages reached historic lows when they breached an average of 3.53%. Not only that, but 15-year fixed mortgages averaged only 2.83%! From the […]

How And Why To Check Your Credit Score If You Plan On Buying A House

When buying a new home it is important to monitor your credit situation as credit scores from FICO or other agencies can have a big impact on what mortgage rate you receive.