As the leaves turn golden across the Midwest this fall, many Americans are thinking about their financial futures, especially when it comes to buying a home.

With housing prices still high in places like Minnesota and beyond, interesting ideas are popping up to make homeownership more accessible. One such idea making waves is the proposed 50-year mortgage from President Trump’s administration.

If you’re like me—a fan of steady, low-risk index investing— you’re probably approaching this with caution. Longer debt terms can seem appealing for lower monthly payments, but they come with risks worth considering carefully.

In this article, we’ll dive into the details of this proposal, explore whether it’s likely to become reality, and cover what you really need to know. We’ll also take a step back to look at the history of mortgages in the United States, the standard loan lengths available today, and how different terms stack up in terms of payments, interest, and overall cost. My goal is to help you make informed decisions that align with a risk-averse approach to personal finance.

Quick Navigation

- The History Of Mortgages In The United States

- Traditional Mortgage Lengths In The US

- Details of President Trump’s Proposed 50-Year Mortgage Plan

- Will the 50-Year Mortgage Come to Pass?

- What People Need to Know About 50-Year Mortgages

- Differences in Payments: Comparing Mortgage Terms

- A Biblical Perspective on Debt

- Conclusion

- FAQ

The History Of Mortgages In The United States

To understand where the 50-year mortgage idea fits in, it’s helpful to know how home loans have evolved over time. Mortgages aren’t a new concept—they trace back to ancient civilizations, but the modern version we know in the US really took shape in the 20th century.

Back in the early days of American history, home financing was rudimentary. In the 1800s and early 1900s, loans were short-term affairs, often just 5 to 10 years, with large balloon payments at the end. Borrowers typically put down 50% or more as a down payment, and interest rates were high. This setup worked for some, but it left many out in the cold, especially during economic downturns.

The Great Depression changed everything. Homeownership rates plummeted as foreclosures soared. In response, the federal government stepped in. In 1934, the Federal Housing Administration (FHA) was created to insure loans, making them less risky for lenders. This paved the way for longer terms and smaller down payments. By the 1940s, the 30-year fixed-rate mortgage became the gold standard, fueled by post-World War II prosperity and programs like the GI Bill.

Fast forward to the 1970s and 1980s, and we saw innovations like adjustable-rate mortgages (ARMs) to combat inflation. The savings and loan crisis of the late ’80s led to more regulations, and by the 1990s, 15-year and 20-year options gained popularity for those wanting to pay off debt faster. The 2008 financial crisis brought even tighter oversight, but the core structure remained: affordable, long-term financing to boost homeownership, which hovers around 65-66% today.

This history shows how mortgages have adapted to economic needs. Now, with affordability challenges amid rising home prices and interest rates, the 50-year idea is the latest evolution—or perhaps a step too far, depending on your view.

Traditional Mortgage Lengths In The US

In today’s real estate market, the most common home mortgage terms are 15, 20, and 30 years. These fixed-rate options provide stability, which I appreciate as someone who prefers predictability in their home loan.

The 30-year mortgage is the most popular, accounting for about 90% of new loans. It offers the lowest monthly payments, making it easier to qualify and freeing up cash for other goals like retirement savings. However, it means paying interest for longer.

The 15-year mortgage is for those who want to build equity quickly and minimize interest costs. Payments are higher, but rates are typically lower—often by 0.5% to 1% compared to 30-year loans.

The 20-year term splits the difference: payments higher than a 30-year but lower than a 15-year, with total interest in between.

Choosing the right length depends on your financial situation. If you’re risk-averse like me, shorter terms reduce long-term debt exposure, but they require stronger cash flow.

We currently are 5 years into a 20-year mortgage, we came down somewhere in the middle.

Details of President Trump’s Proposed 50-Year Mortgage Plan

President Trump’s administration has floated the idea of a 50-year mortgage to address housing affordability, especially for younger buyers facing steep prices in cities from coast to coast. The proposal surfaced during the 2024 campaign and has been discussed more seriously since his inauguration.

From what we know so far, the plan aims to extend the standard loan term from 30 to 50 years, potentially through changes at Fannie Mae and Freddie Mac, the government-sponsored enterprises that back most US mortgages. By stretching payments over five decades, monthly costs could drop by 10-15%, making homes more accessible without needing lower interest rates or prices.

For example, on a $300,000 loan at 6%, a 30-year term might mean about $1,799 monthly, while a 50-year could lower it to around $1,579—a savings of over $200 per month. Supporters argue this could help first-time buyers in high-cost areas like California or New York.

The administration is also exploring portable mortgages, allowing borrowers to transfer low-rate loans to new homes, but the 50-year concept is the headline-grabber.

Will the 50-Year Mortgage Come to Pass?

As of November 2025, the proposal is under active evaluation by the Federal Housing Finance Agency (FHFA). Trump’s team sees it as a way to fulfill campaign promises on housing. However, it’s facing pushback.

Industry experts question the long-term costs: borrowers could pay hundreds of thousands more in interest. There’s also concern about feasibility—lenders might demand higher rates for longer terms due to increased risk. Recent reports suggest the idea is “losing steam” amid these debates.

In my view, it’s uncertain. Congress would likely need to approve changes to Fannie and Freddie, and with divided opinions, it might not happen soon. If it does, it could start as a pilot for certain buyers. Keep an eye on updates from the White House and housing agencies.

What People Need to Know About 50-Year Mortgages

If 50-year mortgages become available, here are some pros and cons to consider.

Pros:

- Lower monthly payments: More budget room for emergencies or investments.

- Easier qualification: Helpful for those with moderate incomes.

- Potential for appreciation: Over 50 years, home values could rise significantly.

Cons:

- Massive interest costs: You might pay double the home’s value in interest.

- Slower equity build: It takes longer to own your home outright.

- Life changes: Committing to debt into retirement age is risky—think about job loss or health issues.

From a risk-averse perspective, I’d stick with shorter terms if possible. Paying extra on a 30-year loan can mimic a shorter one without locking in high payments.

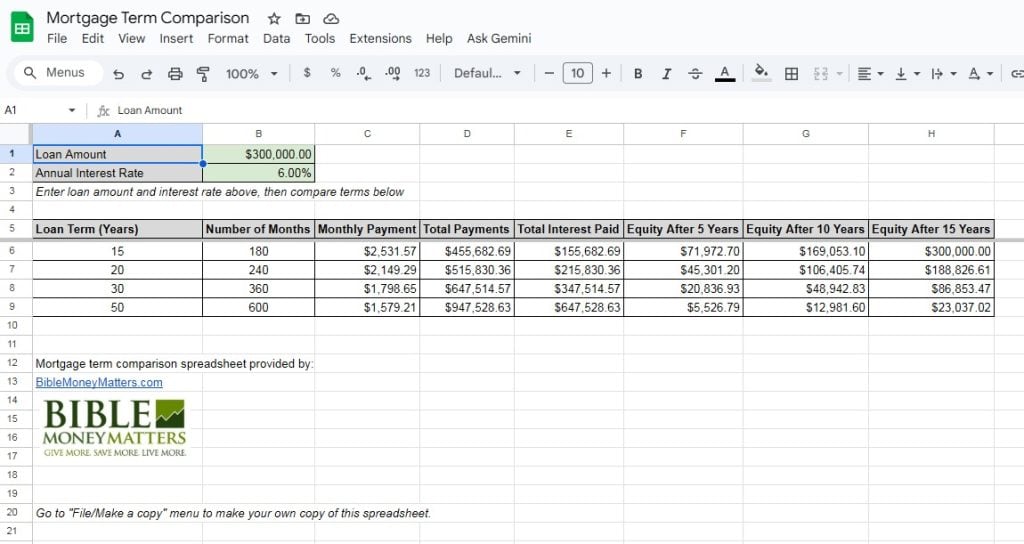

Differences in Payments: Comparing Mortgage Terms

Let’s break down the numbers. Assume a $300,000 loan at a consistent 6% interest rate to isolate the term’s impact (rates vary in reality).

| Term | Monthly Payment | Total Interest | Total Paid |

|---|---|---|---|

| 15-Year | $2,532 | $156,000 | $456,000 |

| 20-Year | $2,149 | $216,000 | $516,000 |

| 30-Year | $1,799 | $348,000 | $648,000 |

| 50-Year (Hypothetical) | $1,579 | $648,000 | $948,000 |

See the pattern? Longer terms slash monthly costs but balloon total interest. In real scenarios, shorter loans often have lower rates, amplifying savings.

Want to compare different mortgage loan terms? Download our handy Excel spreadsheet where you can enter the loan amount, interest rate and then compare interest paid, equity gained, etc for 15, 20, 30 and 50-year mortgages.

- Mortgage Term Comparison Spreadsheet (Google Sheets)

- Mortgage Term Comparison Spreadsheet (Excel)

A Biblical Perspective on Debt

When considering whether to sign on the dotted line for a 50-year mortgage commitment, it’s a good idea to consider some Biblical wisdom. Proverbs 22:7 says,

“The rich rule over the poor, and the borrower is slave to the lender.”

This reminds us to approach debt wisely—aim to minimize it where possible, and don’t allow it to become your master.

Conclusion

The 50-year mortgage proposal could shake up US real estate, but it’s not a silver bullet, and it carries with it some real risks.

Understand what your options are, crunch the numbers, and consult a financial advisor.

For me and my family we’re quite happy with our 20 year mortgage at a 2.375% rate (We lucked out on timing) – which we are a quarter of the way to paying off. For us a longer mortgage like a 50-year mortgage would be a non-starter, just because of the huge costs you’ll be paying in interest alone. Along with that you’ll have a hard time building any significant equity in the first 10-15 years of the loan. Americans stay in their homes on average for around 8 to 13 years before selling or refinancing (source), and first-time buyers often move after 5 to 10 years. So since they aren’t staying in those homes for more than a decade or so, when they sell they won’t have had enough time to build up much equity at all. Definitely something to consider.

What are your thoughts on the proposed 50-year mortgage? Tell us your thoughts in the comments.

FAQ

What is a 50-year mortgage?

A 50-year mortgage is a home loan repaid over 50 years, longer than the standard 30-year term. It lowers monthly payments but increases total interest paid.

How does a 50-year mortgage compare to a 30-year one?

On a $300,000 loan at 6%, a 30-year might cost $1,799 monthly with $348,000 in interest, while a 50-year could be $1,579 monthly but $648,000 in interest—lower payments, higher overall cost.

Is Trump’s 50-year mortgage plan likely to happen?

It’s being evaluated but facing industry skepticism over costs and risks. As of 2025, its future is uncertain and may require congressional approval.

What are the risks of a longer mortgage term?

Risks include paying more interest, building equity slowly, and carrying debt longer, which could impact retirement or handle life changes.

Should I choose a 15-year or 30-year mortgage?

If you can afford higher payments, a 15-year saves on interest and pays off faster. A 30-year offers flexibility but costs more long-term—ideal for risk-averse folks prioritizing cash flow.

Share Your Thoughts: