Today is day two in “In Event Of An Emergency” week here at Bible Money Matters.

The posts this week are looking at ways you can plan ahead for unforeseen emergencies, tragedies or hard times.

Yesterday we looked at how you can make sure that all your important documents are safe by having a fire safe in your home, and a safe deposit box at the bank.

Today I thought I’d take a look at something that’s important for your family to have in the event of your untimely passing or disabling injury.

It’s what I like to call the “What To Do If I Die” spreadsheet or database.

The idea has been written about before by many others in the personal finance community, but it can’t hurt to do it again. It is THAT important. So what is it exactly?

The “What To Do If I Die” spreadsheet is a place where you put together all of your important personal and financial information in one place, where your loved ones can access it in the event that you’re not around to help them.

Here’s a simple one that I put together and that you’re free to use.

Let’s dive in and take a deeper look.

Quick Navigation

What Type Of Information Should I Put In My Spreadsheet?

The type of information that you put in your database is really up to you. For me the things I decided to include were things that I thought my wife might have a hard time finding otherwise, or that would be a pain to track down.

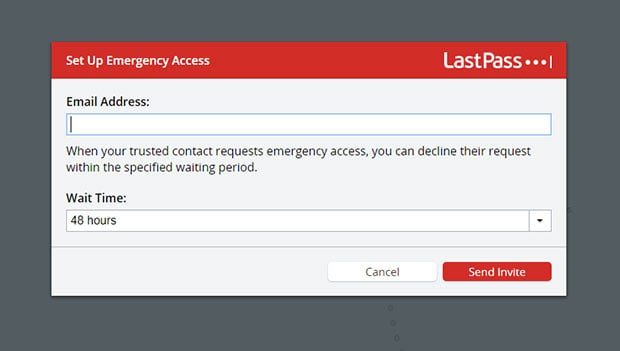

You can include as much or as little information you’re comfortable with. For example if you don’t want to include passwords in case someone gets a hold of your spreadsheet, just keep your passwords separate in a program like LastPass. The software will allow you to save all your account usernames and passwords, and password protect them under one master key.

LastPass even has a system for setting up emergency contacts so that people can access your passwords in an emergency. A good idea for security.

So here are some ideas of what information to include:

Financial and Insurance Information

- Bank Accounts: Add all information regarding your regular checking and savings, in addition to any online savings accounts, money market accounts or CDs. Include things like website addresses, usernames, passwords, account numbers and contact information for the bank.

- Investment Accounts: Put down all information about your 401k, IRA, Roth IRA and other investment accounts that your family may need. Include things like website addresses, usernames, passwords and contact information for the investment accounts.

- Mortgage Account Information: Include all information about your current mortgage, including amount owed, amount due, website addresses, usernames, passwords and contact information for your loan servicer.

- Insurance Information: Include all your information about any life insurance, disability insurance and other insurance that you have purchased. Include website addresses, usernames/passwords and contact information for the insurance company.

- Credit Card Accounts: Include information about any credit card accounts you may hold including website addresses, usernames/passwords and contact info for the credit card company.

- Other Liabilities/Loans: Include other liability information including student loans, auto loans or home equity lines of credit. Once again include any website addresses, usernames/passwords, account numbers and contact information.

Income Sources

Make a listing of all your sources of income, especially ones that your family might not know too much about (like blog income!)

- Regular income: This may be going away, although some benefits may be coming your way after your disability or death. List that information here if you want.

- Side income: Make sure any side income or assets that the family might not know about are listed here. In my case I could list this blog which would continue to collect income if I die. It could also be sold as an asset. Also be sure to include usernames/passwords for all accounts related to that side income.

Monthly Expenses

It can be a good idea to keep a list of monthly expenses that need to be paid in case you aren’t around to pay them. It will make things easier for the person trying to cope with your loss.

- Utilities

- Insurance

- Mortgage

- HOA Fees

- Loans

In doing the list of expenses you may even want to do a complete budget (if you haven’t already) and have a family budget meeting to talk about your finances. If you do that on a regular basis it will make this process that much easier.

Instructions For Collecting Insurance and Benefits

While it may not be fun to think about you may want to write out instructions for how your significant other can collect life insurance, disability or other benefits.

Write out who they need to contact, what they will need to do, and how they will need to do it. This can take a lot of stress out of the situation.

Other Important Info

You may have other important accounts or information that you want your loved ones to know about. Things like locations of wills, safe deposit boxes or the location of those gold bricks you buried in the backyard.

Whatever it is, if your family doesn’t know about it, make sure they do. (You can also include letters to family members in case you die)

Where Should I Keep These Documents?

Once you’ve put together your worksheet of information, it’s a good idea to figure out where to put it. For me I’ll be putting the information in a couple of different places.

- First, it will be kept on my hard drive of my computer in the “My Documents” folder.

- Second, I’ll put it on a USB flash drive and store it in our fire safe. Keep a copy in your safe deposit box if you have one.

- Third, I’ll email myself a copy zipped and password protected to my gmail account. I’ll then label it “If I Die”.

Once I’ve set up all these copies of the document(s) I’ll sit down with my wife and make sure she knows where to find this information in case she needs to.

Update: Reader Nathan suggested the following alternate method for saving your important documents.

- Get a USB flash drive on which you install a password manager like LastPass to securely manage usernames and passwords.

- Install an encrypted drive on the same USB flash drive using something like VeraCrypt. Keep all your important documents there.

- Update your data as needed, and have a software like SyncToy backup all the data to your computer from the USB thumb drive.

- Use a backup service like Carbonite, OneDrive or DropBox and upload your encrypted files on occasion. That way you know your data is backed up off site in case of disaster.

- Keep the passwords for LastPass and VeraCrypt in the fire safe for safe keeping in case you die.

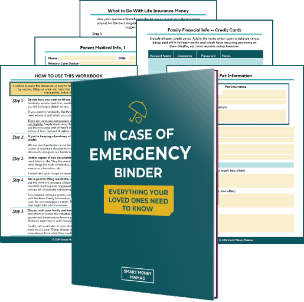

In Case Of Emergency Binder

If you’d like something a little bit more comprehensive than our “What if I Die” spreadsheet above, our friend Chelsea over at SmartMoneyMamas.com has put together what she’s calling an In Case Of Emergency Binder.

The Binder is a complete package that can help you plan for pretty much any eventuality. It’s over 100 pages of simple, printable worksheets (in a fillable .pdf) to organize everything your family may need to know if you’re gone.

It includes sections for things like household information, medical information, key personal documents, financial documents and logins, important contacts, important memories and more.

The binder costs $29, but it’s well worth the cost in my opinion as it will lead to giving you peace of mind that your loved ones are covered in case the worst case scenario were to happen.

Have you set up something like the “What If I Die” spreadsheet at your house? Does having it give you peace of mind? What other things do you think should be included in the spreadsheet? What method do you use to backup important files? Tell us about it in the comments!

Thanks for this great information. I have been married now for 3 years, and have never had a good place to store all of our valuable information. Before today I didn’t even know what I should store and what I could leave out. But it’s always been on my mind that I needed to get prepared. I just didn’t know where to start. Thanks for helping me get started.

I keep meaning to do this. It would take Mark MONTHS to sort out our finances/passwords/accounts if something happened to me. Hrm.. guess it goes on the elephant list.

I’ve done almost exactly what you are suggesting with the spreadsheet and all…I love the idea of having it all backed up on a disk and usb, that way I’m covered 3 times as good. This is important data, and I want my family to have it easily accessable WORST CASE.

Brandons last blog post..Blog Income Report

We really need to do this. We have some spreadsheet that show US our financial situation, but would be hard to locate and interpret by family members in the event of an emergency!

Baker @ ManVsDebts last blog post..Tap Your Social Network To Buy/Sell Used

This is a fantastic idea…. Dave Ramsey talks about this and calls it a Love Drawer. I’ve created something very similar with all the important Insurance and Bank Account information. I even included a letter to my wife to confirm thoughts and ideas that we don’t always stop to convey.

The idea is that it can include so much more than just the mechanics of account numbers but even compiling and clearly communicated the basics will be shout “I love you” if/when the contents are ever required.

Great idea that can’t be communicated enough!

Dave

T. Rowe Price has a free software program called the “Family Records Organizer” that does all of this (except the password and username items). It’s really easy to use and it prints out a nice itemized report (or you can save it as a PDF).

Here’s the site:

http://individual.troweprice.com/public/Retail/Planning-&-Research/Tools-&-Resources/Investment-Planning/Family-Records-Organizer-CD-ROM

Great suggestions. I have a spreadsheet that I use to track our finances, and I have a tab called I.C.E. (in case of emergency) that has all of our accounts, their information, stuff about insurance, so that if something happened to me, my wife would be able to make sense of our money situation and know where to look.

Money Beagles last blog post..What Your Cable Company Doesn’t Want You To Know

Hey, I recognize that spreadsheet in the pic. ;)

You can download it here: http://www.financefreelancelife.com/2009/02/25/one-stop-dashboard-spreadsheet/

PT Moneys last blog post..Closing Credit Accounts will Not Help Your Credit Score

that’s the one! it is linked in the article above as well!

That’s a great idea. We have a detailed budget, but things like account numbers and passwords aren’t really included with that. We do have tabs with our amortization schedule and notes on how much we still owe at the bottom of the budget each month.

Now we just need a fire safe.

thefinancefiends last blog post..Will a Garden save money?

Thanks for your kind comments, and for subscribing!

Did you give a sample of the spreadsheet you talk about? i missed any link to it and if you didn’t i will stop looking on the page. thanks.

I’m sorry, I don’t actually have one here, I meant to do one, but didn’t get to it. Here’s one that others have suggested: Financial Life On One Page

thank you-just needed a starting point and this sure helps

I created a book called the When Im Dead Book. I have all the info you detailed but I also have in the book

Funeral Wishes Pre paid funeral information

Photos of things I want to leave to my kids

How to dispose of special things to friends or other relatives

Living will

Durable power of atty

Reg will

Health power of atty Add POD notations on financial accts…to avoid court

Property assets,,,,named all credit cards ..cars and location of tutles

I added a tab for charitable donations and how they’re given: frequency, account, if AFT, chartiy name/address/email.