The tax filing deadline is almost upon us, and as I am wont to do I’ve once again waited until the last minute to file my taxes.

As I’ve done for the past few years I filed my taxes using my favorite tax software, TurboTax.

TurboTax has gone through quite the metamorphosis over the years, and while their interface has changed, one thing that hasn’t is how easy it is to file using their product.

Today I thought I’d do a brief walk-through of the TurboTax software, and talk about why I think it’s one of the best and easiest products available for doing your taxes.

TurboTax Product Offerings

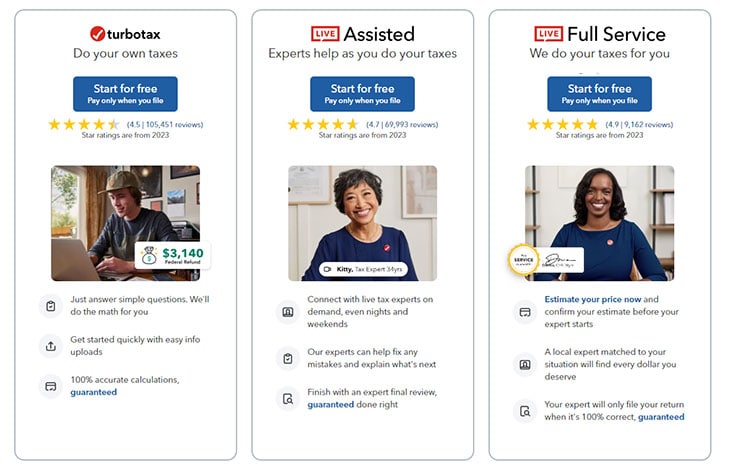

TurboTax has several levels of service offerings. Depending on your tax situation you may be able to file your federal taxes for free if you have a simple tax situation, or if you have a more complex situation with Schedule C income, small business profits or losses, etc. you may need to use something more advanced.

It pays to look at the features of each product, and choose your level of TurboTax based on your individual needs.

TurboTax Online

If you want to file your taxes using the online version of TurboTax, there are several versions.

TurboTax where you do your own taxes, TurboTax Live Assisted where they give you live help, or TurboTax Live Full Service where they do your taxes for you.

Pricing on these products will vary depending on your tax situation and how much help you receive.

TurboTax DIY (Do your own taxes): This version of TurboTax online is the one where you do your own taxes. Enter all of your information on your own, answer simple questions and scan, upload or import your important tax documents. Get an "Audit Support Guarantee", and a "Maximum Refund Guarantee". When you're done you'll pay for what level of service you've used. State e-file is extra.

- TurboTax Free Edition: If you have a simple tax situation without a lot of investment income, tax deductions and other miscellaneous tax situations, you may be able to file your federal and state taxes for free. 37% of taxpayers qualify. Form 1040 + limited credits only.

- TurboTax Deluxe: The most popular version, if you own a home, have charitable deductions or itemized medial expenses, this version may be for you. Federal filing costs $69, while adding state filing will cost $59 per state.

- TurboTax Premium: If you sold stocks, bonds or mutual funds, have cost basis calculations to make or have rental property income and expenses this version might be the one to use. It costs $129 for federal filing, while each state filing is $59 additional.

TurboTax Live Assisted: This version of TurboTax online is the one where you enter your own taxes, but you can get unlimited help from real tax experts, a final expert review before filing and an "Expert Approved Guarantee" in addition to the "Audit Support Guarantee", and "Maximum Refund Guarantee". State e-file is extra. Here are the versions:

- TurboTax Live Assisted Basic: If you have a simple tax situation without a lot of investment income, tax deductions and other miscellaneous tax situations, you may be able to file your federal and state taxes for free. 37% of taxpayers qualify. Form 1040 + limited credits only.

- TurboTax Live Assisted Deluxe: The most popular version, if you own a home, have charitable deductions or itemized medial expenses, this version may be for you. Federal filing costs $139, while adding state filing will cost $64 per state.

- TurboTax Live Assisted Premium: If you sold stocks, bonds or mutual funds, have cost basis calculations to make or have rental property income and expenses this version might be the one to use. It costs $219 for federal filing, while each state filing is $64 additional.

- TurboTax Live Full Service: This version of TurboTax online is the one where TurboTax does your taxes for you. TurboTax will match you with a local expert based on your personal situation, and your dedicated expert does your taxes for you. The expert will sign and file your return for you once they review it with you. State e-file is extra. Starting at $129*, depending on your tax situation, while adding state filing will cost $64 per state.

* Price estimates are provided prior to a tax expert starting work on your taxes.

Step By Step Tax Filing

Filing your taxes with TurboTax is extremely easy, and one of the reasons I keep going back to their software despite it not being the cheapest is the ease with which I’m able to take my somewhat complicated situation and make it a bit more simple.

They not only take your hand and walk you through the process, but they also have a helpful “ask a question” box at the top of every page where you can ask questions and quickly receive answers that are relevant to the page you’re on. Not sure if you’re eligible for a deduction? Ask and you’ll find an answer!

Entering Personal Information

When you login to the software for the first time it will take you by the hand and start walking you through the process of entering all of the information they need in order to file your taxes.

If you’ve filed your taxes online before with TurboTax, you likely will be able to transfer your information from your previous year’s tax filing and skip right over entering all your personal details like names, social security numbers, dependents, etc. For me, I’ve been using TurboTax for over a decade, so I was just able to transfer all of that information over, check it for accuracy and move on to the next step. Quick and easy!

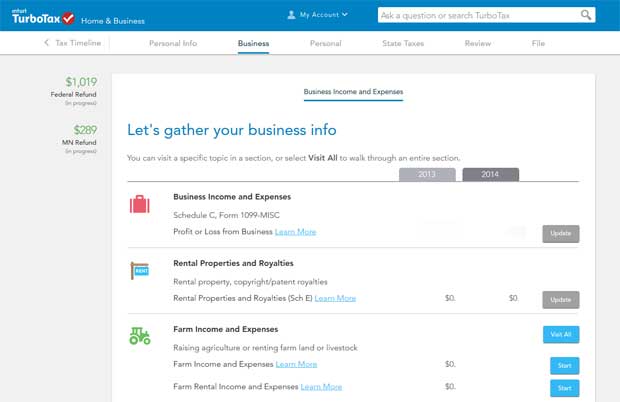

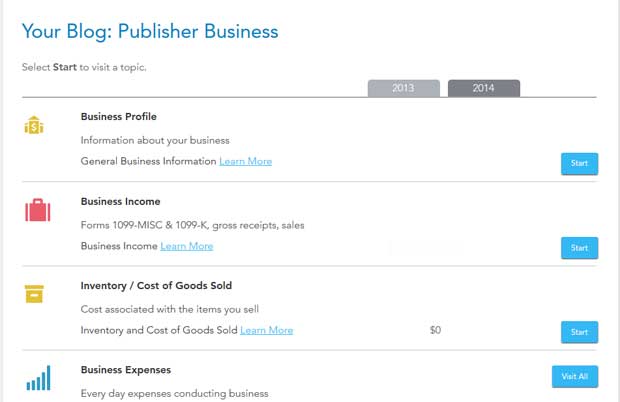

Entering Business Income & Expenses

Since I was using the Home & Business version the steps I took may be a bit different from the other versions because I also had to enter information about my side business including business income and expenses. TurboTax made the process easy, however, walking me through each section, explaining which forms I would need at what point, and allowing me to flag any items that I would need to come back to at a later time.

I actually started my taxes way back in January, but at the time I still hadn’t received all of my tax forms yet from companies I work with, so I flagged the items I was missing and put it on hold until I had all the required paperwork. Then I was able to go back to those flagged items later on and complete them before filing.

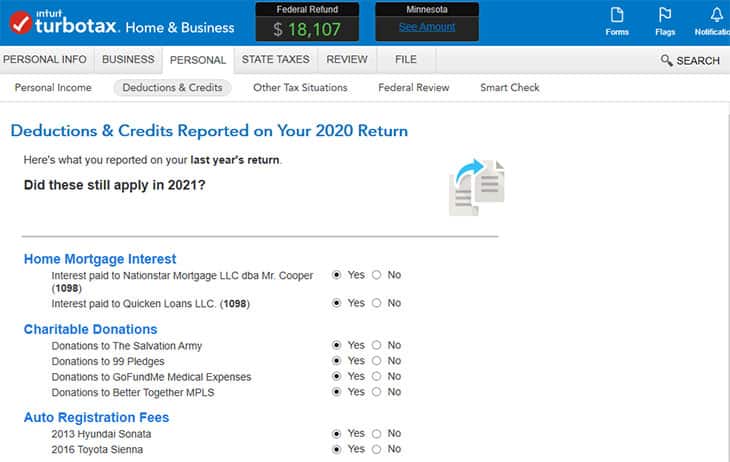

When entering income, expenses, deductions and so on TurboTax will often give you a snapshot view to compare the current year to last year. That way you can compare and make sure that things are in line with last year’s totals, and help you make sure you haven’t forgotten to enter anything. On one of these screens this year I realized that I had forgotten to enter some deductions that I was eligible for, and was then able to enter it.

Entering Personal Income, Deductions & Credits

After entering all of your business income (if you have it in your version), you’ll be asked to provide all of your personal tax information. It will ask for your income first, where you’ll enter any W-2 forms you have (and they can import them for you in some cases so you don’t have to enter them), along with various other income reporting forms that you’ve received.

After entering your income it will walk you through figuring out which tax credits and deductions that you’re eligible for. This will include things like mortgage interest deductions, property tax deductions, child tax credits, earned income tax credits and more. The software will ask you a wide range of questions to figure out which deductions and credits you’re eligible for.

TurboTax Error Check And Review

Once you’ve entered all of your pertinent information the software will do a review of what you entered, and check for errors. If it finds things that need to be updated or fixed (like if you left a field blank where there should have been data entered) it will let you know.

For example, on one investment income section I accidentally left one of the fields empty. I was then able to go back and update it before completing my taxes.

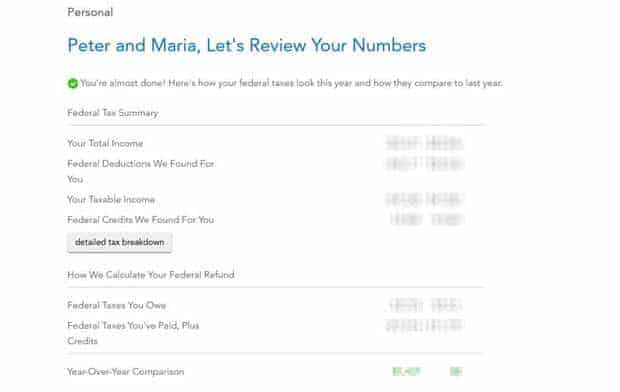

Once everything checks out your final numbers and a review of your taxes will come up before you file.

The software will give you a year-over-year comparison of your tax situation, how many credits and deductions you’ve qualified for, what your taxable income was and a breakdown of your tax situation.

Once you’re satisfied that everything looks correct you’re able to file your federal tax return.

Filing For State Taxes

Once your filing for federal taxes is complete, you’ll need to complete a second process for filing your state taxes. For me that meant filing for one state, Minnesota.

Most of your state filing information will be transferred over from your federal forms, but you’ll also need to answer some state specific questions in order to file. For me this part of the process only took an additional 10-15 minutes.

If you want to e-file your state returns as well, as mentioned above there is the state filing fee. For most products it costs $45.

Filing Your Taxes

Once you are satisfied that your returns are complete and accurate, you can file them. At this point you’ll need to pay the fees associated with using the software (up until this point it is all free to enter your information and play around with the software if you want).

After entering your credit card information (or asking the software to deduct the fees from your refund) it will charge you for using the software and then allow you to e-file.

Once you’ve e-filed your returns it will give you an email confirmation that they’ve been filed, and a message that once the federal and state returns are accepted that you’ll get an email notification.

TurboTax Pros & Cons

When I got a .pdf copy of my tax return, on the last pages it showed me a review of my tax situation for the past few years. In checking my records it does appear that I’ve been using TurboTax for 10 years now! Here are some of the reasons why I’ve been using it for so long.

Easy to use and file: The product couldn’t be easier to use and makes a complex tax filing process and simplifies it for the average user.

Easy document importing: You can easily import your W-2 or investment company statements from over 150 financial institutions. I was able to import from most of my brokerage and retirement accounts to make it a lot less manual data entry.

Great support: The help and FAQ sections are top notch, and if you need extra help you can get on the chat or make a phone call. I did both this year and they were very helpful.

Audit support: If you want extra assurance you can purchase audit support, and TurboTax will represent you if you’re audited.

Simplified health care reporting: With Obamacare requirements, all required ACA health care reporting forms are included for free. TurboTax also has a new health care portal so you can figure out if you meet ACA requirements.

While I do like using the software, there are some downsides that need to be acknowledged.

Cost: TurboTax is not the cheapest option available to file your taxes. There are other options out there that are more cost-conscious.

Try TurboTax

If you haven’t yet started filing your taxes, now would be a good time to start!

If you want to give TurboTax a try, it’s free to use the software right up until the point where you file. So if you want to try it out before paying and compare it to another software, you can do that.

To get started just click on the link below and it will take you to the screen where you start the process.

Company | Free Federal? | Free State? | Notes | Learn More |

|---|---|---|---|---|

*37% of taxpayers qualify. Form 1040 + limited credits only. | ||||

Free for simple returns. | ||||

Free for W2 returns with no dependents. | ||||

100% free for all. | ||||

Free for simple returns. | ||||

Free federal, state $12.95. | ||||

Free federal, state $12.95. | ||||

Free for some simple returns. | ||||

Free federal, state $9.95 | ||||

Free federal, state additional | ||||

N/A | Free federal tax prep only. No state available. | |||

Cell | Cell | Cell | Cell | Cell |

Share Your Thoughts: