Among a growing number of currently available options, Credible has rapidly become one of the go-to online sources for both student loan refinances and private student loans for current and active college students.

You can complete a single, simple online application and receive Instant prequalified rates.

Credible has also expanded its loan offers to include other types of financing, including personal loans, mortgage loans, and mortgage refinancing.

Credible allows you to get your prequalified rates today from some of the best names in each lending field, and to begin the formal application process directly on their website.

*For illustrative purposes only

About Credible

Based in San Francisco, and founded in 2012, Credible is an online loan marketplace. The platform specializes in student loan refinances and private student loans, but has also expanded into personal loans, and mortgage financing.

As an online loan marketplace, Credible gives you the ability to get personalized prequalified options from multiple lenders, many of which are among the leaders in their respective industries. You’ll complete a single online application, receive quotes from participating lenders, and then choose the lender and program you feel will work best for you. With response times in mere minutes, you won’t need to wait long to get your quotes.

Just as important, your online application will make use of a “soft credit pull” that won’t affect your credit score. The hard credit pull will come only when you formally apply with the lender of your choice.

The platform also advertises mortgages, although it is brand-new to the platform, and is still ramping up.

The company has a rating of A+, which is the highest rating on a scale of A+ to F by the Better Business Bureau.

Credible Student Loan Refinances

So what does Credible have to offer when it comes to student loans?

Minimum and maximum loan amounts: Varies by lender, but expect a general range of $5,000 up to $500,000. Funds can be borrowed to partially or completely refinance your current student loan debt up to the maximum amount you owe.

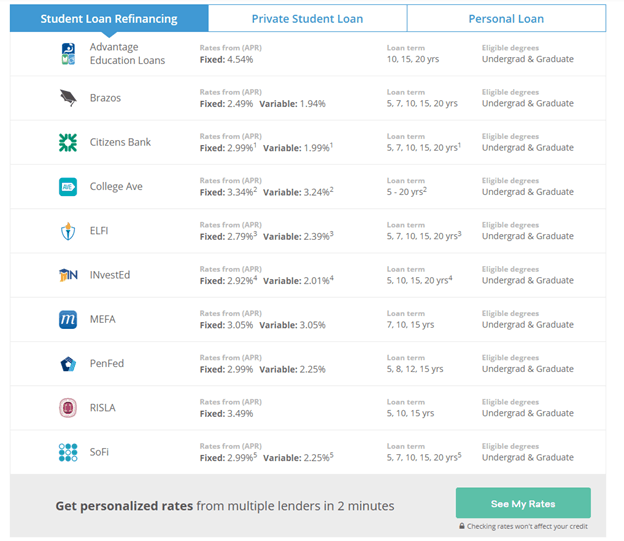

Participating lenders (10): Advantage Education Loans, Brazos, Citizens Bank, College Ave, ELFI, INvestEd, MEFA, PenFed, RISLA and SoFi.

Minimum credit score requirement: Varies by lender, but you can generally expect the minimum score to be 670 or higher. And of course, the higher your score, the lower your interest rate will be. All current student loan accounts must be in good standing and your credit report must not reflect a bankruptcy or accounts recently placed in collections.

Available loan types: Fixed rate and variable rate loans.

Loan terms: Varies by lender, but generally between five years to 20 years.

Qualifications: Again, this varies by lender, but each will consider your employment, income, and debt-to-income ratio in addition to your credit score in making the final loan decision.

Eligibility: You generally must be a US citizen or permanent resident alien, at least 18 years old, and either have graduated and be employed, or be within six months of graduating with a promise of employment that must be submitted with your application. With some lenders, your degree and the school you attended will also be qualifying factors.

Availability: Collectively, all 50 states, though not all lenders are available in all states.

Loans eligible for refinance: Federal student loans, private student loans, and Parent PLUS loans.

Cosigner permitted: Yes, but you should indicate the need for a cosigner when completing your initial application. Credible will provide quotes from lenders that accept cosigners, as not all do.

Cosigner release: Varies by lender.

Loan servicing: Varies by lender.

Mobile app: Not offered. Mobile optimized website.

Customer service: Available by phone, live chat, or email, Monday through Thursday, from 6:00 am to 6:00 pm; Fridays, from 6:00 am to 4:00; and weekends from 7:00 am to 4:00 pm – all times Pacific.

Forbearance Due To Economic Hardship

Some – but not all – participating lenders do provide forbearance due to economic hardship. Specific terms will vary by lender.

This can take different forms, including payment suspension and interest deferral for up to 12 months due to the involuntary loss of a job or other economic hardship. Others may provide special forbearance for active military duty.

In most cases, your loan will be automatically discharged upon your death.

Credible Student Loan Refinances – Rates and Fees

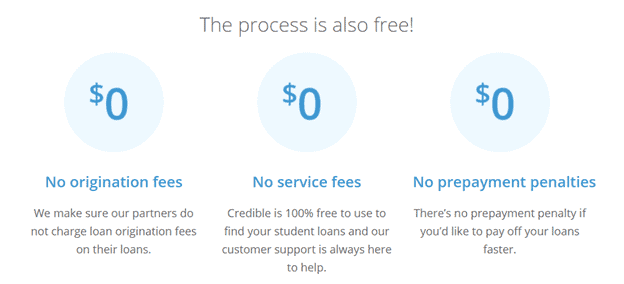

There are no fees payable to Credible or its participating lenders. That means no loan application fees, origination fees, or prepayment penalties.

Interest rates vary by lender. (Be aware that not all participating lenders offer variable-rate loans).

Credible Private Student Loans

Minimum and maximum loan amounts: Varies by lender but ranges from $1,000 up to the entire cost of attendance for the academic year, less other financial aid and loans you’ve already received. Available for both undergraduate and graduate degrees.

Loan funds purpose: Proceeds can be used to pay for direct education costs, as well as living expenses. Examples include tuition and fees, room and board, housing, utilities, meals, and groceries, books and supplies, a personal computer you’ll use for school, and even dependent childcare expenses.

Participating lenders (7): Ascent, Citizens Bank, College Ave, EDvestinU, INvestEd, MEFA, and Sallie Mae.

Minimum credit score requirement: Varies by lender, but the same as for student loan refinances. You must generally have a minimum credit score of 670.

Qualifications: Generally the same qualifications as for a student loan refinance. However, most lenders will require a qualified cosigner if you are a full-time student or under 18, and lacking either the income or the credit history to qualify.

Eligibility: You must be a US citizen or permanent resident alien, and attending a college or university accredited with the US Department of Education under Title IV.

Available loan types: Fixed rate and variable rate loans.

Loan terms: 5, 7, 10, 12, or 15 years, though some lenders will go as long as 20 years.

Grace period: Repayment terms generally provide for deferment of up to six months after graduation.

Availability: All 50 states but varies by lender.

Cosigner permitted: Cosigners are permitted and must meet the eligibility criteria described above.

Cosigner release: Varies by lender. Some may allow a cosigner release if the primary borrower makes the payments on time for a certain number of months (generally, 24 to 36) and can demonstrate both the income and credit score to qualify alone. With others, cosigners must remain on the loan until it is fully paid.

Loan servicing: Varies by lender.

Mobile app: Not offered.

Customer service: The same as for student loan refinances.

Forbearance due to economic hardship: Varies by lender but will generally be the same as it is for student loan refinances.

Credible Private Student Loans – Rates and Fees

Just as is the case with student loan refinances, private student loans have no application fees, origination fees, or prepayment penalties.

Interest rates vary by lender.

Credible Personal Loans

Personal loans are unsecured loans that may be used for any purpose (except for student loans, due to federal regulations). Personal loans are available in fixed-rate only. Credible makes personal loans available through its online loan marketplace and includes participation from more than a dozen lenders.

The terms and features you can expect to see include the following:

Minimum and maximum loan amounts: $600 up to $100,000.

Loan Terms: Between one and seven years.

Participating lenders (16): Avant, Axos, Best Egg, BHG Money, Discover Personal Loans, FreedomPlus, Happy Money, LendingClub, LendingPoint, LightStream, OneMain Financial, Payoff, PenFed, Reach Financial, SoFi, Universal Credit, Upgrade, Upstart and Zable.

Interest rates and fees: Interest rates vary by lender, depending on your credit and income profile, and the purpose of the loan. There are no application fees or prepayment penalties, but some lenders charge origination fees that can range between 1% and 8% of the amount you are borrowing. This fee will be deducted from the loan proceeds upon funding and will not be charged in advance or if your loan is not finalized.

Credible Personal Loan Best Rate Guarantee: Credible will give you a $200 gift card. If you find and close a personal loan with a better rate from another source. The better rate must be received within eight days after receiving prequalifying rates on Credible, and not be provided by a lender that offers prequalifying options on Credible.

Minimum credit score requirement: Varies by personal loan lender, but the higher your score, the lower your interest rate will be.

Qualifications: Varies by personal loan lender, but you will need to be steadily employed with a predictable income that will comfortably support your current housing and debt payments, as well as the payment on your new loan.

Eligibility: You must be at least 18 years old, a US citizen or permanent resident alien, with sufficient income and credit to support the loan amount you are applying for.

Availability: Available in all 50 states, but not all participating lenders make loans in all states.

Cosigner permitted: Cosigner eligibility is not indicated on the web platform and should not be assumed.

Cosigner release: N/A.

Loan servicing: Varies by personal loan lender.

Mobile app: Varies by personal loan lender.

Customer service: Varies by personal loan lender.

Forbearance due to economic hardship: Forbearance is generally not available on personal loans.

Credible Mortgage Refinancing

Credible only recently rolled out its mortgage refinancing offer, which apparently does not apply to purchase money mortgages or secondary financing, like, second mortgages, home equity loans, or home equity lines of credit.

They include participation by several lenders allowing you to select the best rate and program.

Refinancing can be for rate and term refinances, as well as cash-out refinances. Both fixed rates and adjustable rates are offered, with a 30-year fixed-rate loan, and a 15-year fixed-rate loan. Adjustable-rate loans (ARMs) are not offered.

At present, the Credible mortgage platform offers only conventional loans. FHA and VA loans, as well as jumbo loans, are not available.

Peter, who runs this site, just refinanced his own home mortgage through Credible and had a great experience. He lowered his interest rate by 1.5%, dropped 3 years off his loan, and will save almost $60,000 in interest. Not only that he lowered his monthly payment! Check out his review on how easy the process was next week.

Credible Operations, Inc. NMLS# 1681276, “Credible.” Not available in all states. www.nmlsconsumeraccess.org.

How To Apply With Credible

The specific process for applying with Credible will depend on the loan type – student loan refinance, private student loan, personal loan or mortgage refinancing.

While the pre-qualifying application will be done through Credible, you’ll need to make a formal application through the participating lender of your choice.

Credible eligibility requirements are as follows:

- You’ll need to be at least 18 years old unless you are applying for a private student loan as a student.

- You must be either a US citizen or a permanent resident alien.

- If you are applying for a private student loan, you must indicate if you will be using a cosigner and indicate the school you will be attending and the degree you are pursuing.

- You must meet the minimum criteria for credit score and credit quality, employment, income, and debt-to-income ratio for any loan type you apply for.

The online application you’ll be completing with Credible is preliminary and only for prequalification purposes. A more detailed application – requiring a larger amount of information – will be requested by each participating lender.

Credible Pros And Cons

Credible has a lot of positives in its corner, along with a few things to be aware of.

Pros:

- You can apply for a loan in just two minutes.

- The platform offers participation by multiple lenders, allowing you to choose the best program and rate you can qualify for.

- There are no application or origination fees (except on personal loans), and no prepayment penalties.

- You can add a cosigner to private student loans if you don’t qualify on your own.

- Very generous maximum loan amounts—up to $500,000 on a student loan refinance, or up to the full amount of your cost of school attendance for private student loans.

- Credible personal loans offer a $200 gift card if you find a better rate from another source.

Cons:

- Credible student loan refinances include participation by 10 lenders, which doesn’t represent the entire industry. The number of lenders is limited to seven for private student loans.

- Co-borrowers and cosigners are not available on student loan refinances or personal loans.

- Credible does not offer a mobile app, but you can access the web platform from your mobile device.

Who Will Credible Work Best For?

Credible began as a source of student loan refinances and private student loans, and it continues to be one of the best platforms for obtaining either type of loan. As an online lending marketplace, they offer financing from some of the most prominent lenders in the student loan industry. As well, neither Credible nor any participating lenders charge any fees, like application or origination fees.

You can complete your application and receive quotes within two minutes. That will give you an opportunity to get the best rate and terms, and to do it in a lot less time than it would take you to apply to several individual lenders. You can also make an application with a soft credit pull, that will not affect your credit score.

Credible is also rapidly developing into one of the primary sources of personal loans. They offer participation from no less than 16 lenders, many of which are among the best-known lenders in the personal loan space. They’re so confident they’ll be able to provide you with the lowest rate on a personal loan that they’ll give you a $200 gift card if you find a better rate elsewhere.

Credible now also offers mortgage refinancing. While the lender lineup and program types are a bit limited, given their success in student loans and personal loans, it’s likely Credible will build out its mortgage platform and become a top source over time. Given that Peter already has had a good experience refinancing through Credible, it bodes well for the service.

For student loan alternatives to Credible, please see our guide, 10 Best Places to Refinance Student Loans.

If you’d like more information or you’d like to apply for a private student loan, student loan refinancing, a personal loan, a mortgage refinance, visit the Credible website.

Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate. All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Rates from Lenders may differ from prequalified rates due to factors which may include, but are not limited to: (i) changes in your personal credit circumstances; (ii) additional information in your hard credit pull and/or additional information you provide (or are unable to provide) to the Lender during the underwriting process; and/or (iii) changes in APRs (e.g., an increase in the rate index between the time of prequalification and the time of application or loan closing. (Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time). Lenders reserve the right to change or withdraw the prequalified rates at any time.

Share Your Thoughts: