Buxfer.com is a new personal finance site that allows you to bring all your personal finance information together in one place, along the lines of competitors Mint.com, Geezeo.com. I recently signed up for the service so that I could weigh its advantages against the one I’m using right now, Mint.com.

We recently became more deeply involved in keeping track of my family’s finances, and we wanted to find a way to keep track of our finances online. Ideally we should be able to monitor all of our online accounts, regardless of what institution they’re held at. We should be able to track balances, monitor big transactions, and be able check it from anywhere.

In brushing up on what was out there I found a bunch of reviews of Buxfer.com. I signed up for the service so that I could weigh its advantages against another one I’ve used, and reviewed on this site, Mint.com.

DESIGN:

The first thing you notice when you come to Buxfer.com is their simple no frills design. The page has a white background, with links to accounts on the left, and tabs to different sections at the top. When you first login you’ll be taken to a summary page that lists some spending trends, account balances, and quick links to other sections of your account. Again, the design is pretty basic and clean, keeping the focus on what you’re doing here, balancing your checkbook. If you know what the gmail interface feels like, this is pretty similar. I don’t love the design, but it is definitely functional, and not ugly by any means.

FUNCTIONALITY:

In setting up my account for the first time, the first thing I did was bring together all of my account numbers, online account usernames and passwords, and anything else I would need to enter to get things going. In setting up my 8 accounts that I would be entering into Buxfer, the first two, both credit cards, went very smoothly. I entered my online user information for those banks and the information was imported without too much trouble.

I then moved onto adding my checking, savings, money market and 401k accounts. This is where things started to get a bit trickier. Four of my accounts are at a local bank here in Minnesota, and for whatever reason Buxfer had never heard of the bank, and is not compatible with their online services. This is a huge problem for me because most of my main bank accounts are located at this bank. In setting up online services at mint.com, I was able to setup this bank without too many problems (some slight login issues). Not so at Buxfer. Because of this, my main spending accounts would not be able to update transaction data without my manual intervention.

My other online accounts for our mortgage and 401k accounts proved not to be compatible with automatic updates either, and we had to manually enter them as well. This isn’t as much of an issue for me as transactions with these accounts are less frequent and easily entered into the system.

Once all of our accounts were entered, we started looking around the site to see what some of the things we could do were. In their invitation email they lay out some of the features of the software:

- Automatically download transactions from your bank or credit card (mixed results for us)

- Analyze and visualize where you spend your money (basic but effective)

- Control your spending with budgets and mobile alerts (Great tool for controlling spending)

- Track shared expenses and I-O-Us (e.g., rent, groceries with room-mates) (one of the strong suits of the software)

- Transfer money online and settle your debts (we didn’t use this)

- Access specialized iPhone / Blackberry interfaces “on-the-go” from your mobile device (I don’t have one of these fancy phones!)

These are all things that Buxfer can do if you really delve into it. The main area of concern that I had was in tracking my family’s expenses. To do that, I went to the “Analysis” tab of the software.

Previously I had gone into my transaction data and tagged all of the transactions in categories that made sense. The tagging schema was easy to use, and once I set up my own categories it was relatively easy to setup future transactions to go into the correct categories.

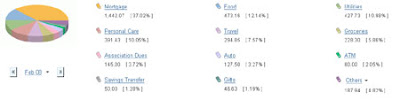

The analysis tab shows you quickly in a couple of different ways where your money is coming from, and where it is going.

Once you have checked out the analysis tab you may want to try and set up a budget so that you’re not overspending in areas you may have in the past. To set up a budget item is very simple – you just specify the budget area you want to set up a limit for, the amount you want to spend, and then specify keywords and tags that should be included in your budget. Then you tell it what time period (1 month for example) you want to track, and it starts that budget item to tracking. Again, simple yet effective.

PROS:

- Simple to setup new accounts.

- Simple Gmail-like design: No overpowering colors or over the top Web 2.0 schemes.

- Simple yet effective tabs structure: They keep it simple, but the options they give you are very useful.

- Useful graphs and charts: Charts that give you good, useful information.

- Balance and spending alerts: keeps you up to date on what money is coming in, or out.

- Budgets: Ability to track and stay within a budget in one or multiple areas.

- Ability to track spending for groups: track what you owe, or what others owe you. Also gives you ways to pay them.

CONS:

- Problems in setting up accounts with some banks

- limited options for investment and savings accounts: No simple way to setup 401k accounts or some other more advance savings options

- Clunky importing of data: Some data imports re-imported the same data as new transactions.

CONCLUSION: So far in the three weeks I’ve been using Buxfer.com I have enjoyed using the software. The software gave us good feedback as to problem areas in our accounts, as well as being a simple and straight forward way to keep tabs on our spending. Granted, the software gave us fits in trying to setup our main spending accounts (which we never really did resolve), but they are making updates all the time and hopefully these issues will be worked out by the developers without too much delay.

I will recommend Buxfer.com to those of you out there who are able to get the software up and running with your accounts. Once you’ve got things loaded, and your accounts download automatically, it should be much more of a joy to use. As for me, I’ll be sticking to mint.com for my online finance manager as it has been a bit more of a “set it and forget it” type option.

I have had a horrible experience with Buxfer. Me and my friends used buxfer to keep an account of our expenses.

Recently I have noticed, it just edit the transactions itself, makes copies of existing transaction corrupting the entire balance and making it impossible for us to keep track of who owes how much to who.. they have major software glitches and they dont even respond to your email queries/ concerns

Ashima,

Are you running the Basic, Plus, Pro? What is the Reconciliation process like? Have you ever used Quicken Starter Edition, or Moneydance?

I have been using Buxfer for almost 2 years. Initially everything ran smooth. All 15 of my accounts synced, I exported to my own spreadsheet I use for data analysis, and all was good.

Then my Credit Union updated their website and security. That was 7 months ago and Buxfer has yet to get the sync function to work consistently and correctly since then.

I tried using MINT but I cannot modify the Categories. I have spent MANY hours on my data analysis spreadsheet to categorize transactions and I don’t want to re-invent the whole thing. MINT also had issues in the past with creating multiple exact transactions.

Currently I have been unable to find an aggregation website that works consistently and has modifiable categories. It looks like I may have to download every account manually which will take forever every week.

Buxfer has really disappointed me. They use Yodlee as their aggregator so I won’t even consider them now.

Sorry, but the review is not worth reading without a date. When was it written? Today? Three years ago?

The review was written several years ago, so a lot has changed since it was written. It may be time for an updated review to be written.

My experience with buxfer is not good. It is unable to sync all accounts associated with the bank. For example I have 19 FD accounts. It only syncs 10. I am a paid member.

Also there are lot of issues with sync with bank and investment accounts. If I am paying a significant amount for the subscription buxfer should address this as soon as possible. But my support requests remain unanswered.

Looks like buxfer support is horrible. I have raised a request 15 days ago. Still there has not been an answer.